What is Crowdfunding?

What is Crowdfunding?

Traditionally, if you wanted to raise capital for a new business, project, or venture, you would have limited options. You could secure a loan from a bank. You could persuade friends and family, Venture Capital (VC) funds or angel investors to invest in your business. Or, if you have saved enough money over the years, you could bootstrap the business yourself. During the last decade, a new option emerged for entrepreneurs looking to raise money: crowdfunding.

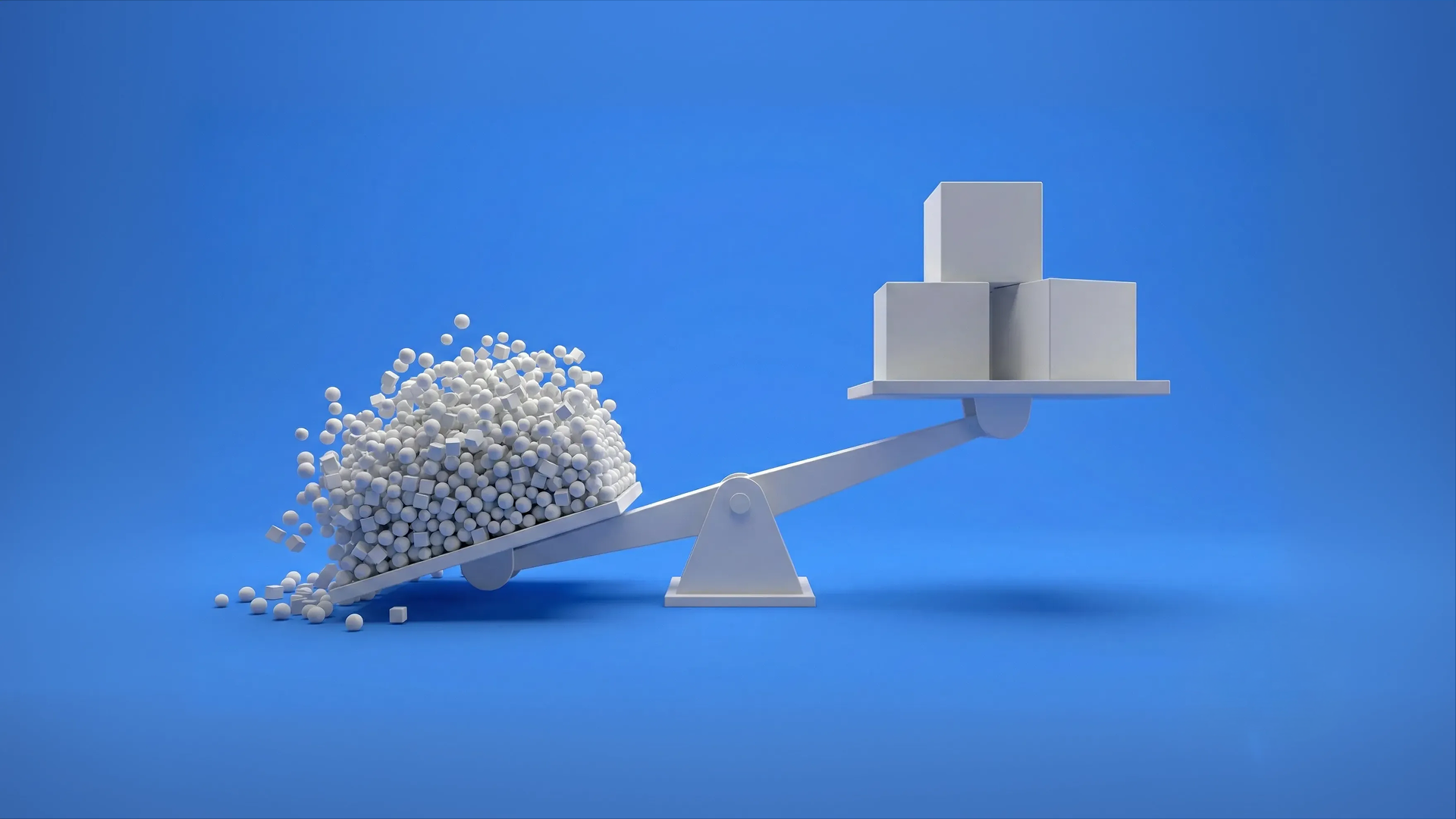

Simply put, crowdfunding is the method of raising capital from a large number of individuals. Each individual is investing a relatively small amount of money, which is pooled together to provide the funds needed for the project. In return, investors receive financial and/or non-financial benefits, depending on the type of crowdfunding campaign.

Types of Crowdfunding

There are four major types of crowdfunding, each one with various features, appeal, and rewards for backers. Crowdbase is offering investment-based crowdfunding, which is Equity and Debt crowdfunding.

- Equity crowdfunding: Allows backers to acquire an ownership stake in a private business, proportional to the total amount invested. As equity holders of the business, investors enjoy financial benefits in dividends or returns (e.g. company sales). This type is popular among startups that struggle to secure financing through traditional sources due to their high-risk-return profile.

- Debt crowdfunding: In this type, companies borrow money from investors and repay them over time with interest. Debt crowdfunding is popular among small and medium-sized enterprises (SMEs), with relatively steady cash flows.

- Rewards-based crowdfunding: Backers receive different non-financial benefits in exchange for their money. This could range from a small thank you note to a final product delivered to your doorstep. One of the most established platforms for this type is Kickstarter.

- Donation-based crowdfunding: This is when individuals donate money to specific causes and charities. With a donation, individuals have the opportunity of effecting positive change in their communities, indirectly receiving non-financial benefits.

Equity-based crowdfunding is growing in popularity because it allows startup companies to raise money without giving up control to venture capital investors. (Investopedia)

What's in it for the investor?

Beyond the obvious potential for returns, crowdfunding offers a range of side benefits to investors, such as:

- Accessibility: Allows individuals to invest in otherwise inaccessible investment opportunities with small amounts of money. In the past, these investments were reserved for high-net-worth individuals and institutional investors willing to tolerate high risk. However, through a crowdfunding platform like Crowdbase, anyone can own a piece of real estate or the next startup unicorn.

- Quality and security: By using a reputable platform like Crowdbase, investors can benefit from the extensive due diligence process that each business undergoes before being accepted onto the platform. As a result, this guarantees transparency of information and high standards for all investment opportunities found on the platform.

- Social impact: Other than the financial benefits of investing through the platform, investors can positively influence their community’s development. Backers are endorsing and enabling innovative ideas to flourish in their community with their investment, indirectly benefiting them. With crowdfunding, the power lies with investors to take action and deploy capital in socially impactful projects without waiting for local authorities or the government to act.

You can find additional details on the returns you can expect in our Understanding Investor Returns article.

What's in it for the entrepreneur?

Although raising money is usually the main goal of a crowdfunding campaign, it also comes with additional benefits to complement your funding round.

Crowdfunding can provide startups with access to a broader pool of investors, a more cost-effective fundraising method, a community of brand advocates, valuable feedback and market validation.

- Marketing exposure: Regardless of the campaign’s outcome, your business will gain significant exposure to the platform’s investor base. Additionally, intense marketing efforts from both the platform and the company can increase the company’s exposure and visibility across its target markets.

- Fundraising efficiency: Running a crowdfunding campaign means that all information an investor needs to take an informed decision can be found in one centralised location, the campaign page. This eliminates the need for you to explain the same things repeatedly to multiple potential investors, as you can redirect them to the campaign page to find the investment information they need, allowing you to focus on running your business.

- Concept validation: A successful campaign is the perfect proof of concept and validation of a potential market for your product or service. Managing to hit your funding goal with a large number of investors goes to show that these people believed in you and your product/service. Using the momentum of a successful campaign, you can later raise additional funds from institutional investors.

- Brand advocates: Crowdfunding can help startups build a community of engaged supporters and customers. By investing in the company and becoming early adopters of your product or service, these investors become your brand ambassadors, spreading the word about your company and helping attract new customers.

- Crowdsourcing of ideas: You can source suggestions from different perspectives by presenting your business to thousands of potential investors, customers, and community members. This can provide you with invaluable feedback and ways to improve. It is then up to you to evaluate the information sourced and update your plans accordingly.

Learn how to raise capital with Crowdbase on our Raise Capital page.

OK, so how does Crowdfunding actually work?

- A business wants to raise capital for a new project or venture. It applies to a crowdfunding campaign through the Crowdbase platform.

- Crowdbase performs a review of the company's business, information verification, and KYC procedures.

- Crowdbase works with the business's management to finalise the specifics of the campaign (valuation, interest rate, repayment schedule etc.).

- The Key Investment Information Sheet (KIIS) is produced, which is used by investors to find all relevant campaign information.

- A crowdfunding campaign is created on our platform. Here, investors can assess whether this would be a worthwhile investment opportunity for them.

- Investors start investing in the campaign through the platform. Investors' money is kept by Crowdbase until the target funding amount is met.

- Once the funding target is met, Crowdbase transfers the money to the business. Investors receive their securities based on the amount they invested and the type of campaign.

Learn more on our How it Works page.

Risks of Crowdfunding

Crowdfunding does not differ a lot from any other investment platform in that any capital invested is at risk. Common crowdfunding risks include:

- Investment risk: It’s essential to assess the level of risk associated with the investment opportunity before investing. The KIIS should give you a clear indication of the potential investment risks of the campaign. You should then decide whether this investment fits in your investment portfolio.

- Unsuccessful campaign: This is the risk of investing in a campaign that eventually does not meet its target amount. The industry standard, and Crowdbase’s policy, is to return all funds to investors without penalties or fees.

- Regulation: As crowdfunding is still developing, especially in Europe, each platform’s degree of sophistication can vary greatly. Regulation is, therefore, an important aspect that also changes as the industry develops. Crowdbase is an investment services company regulated by the Cyprus Securities and Exchange Commission (CySEC), which dictates measures to protect investors and their money. Learn more about Investor Protection on Crowdbase on our dedicated Security page.

Find more crowdfunding risks on our Risks page.

Key Takeaways

In conclusion, crowdfunding stands as a revolutionary approach, breaking down barriers and creating opportunities in ways that were once unachievable. It not only democratises investment, allowing individuals to fund exciting and innovative ventures that were once beyond their reach, but it also enables companies to raise capital with greater efficiency than traditional channels like banks or venture capital funds.

Moreover, crowdfunding offers a profound societal benefit. It provides investors with the chance to effect tangible, positive change by directing their resources towards socially impactful projects within their own communities. Underfunded sectors such as green energy initiatives and other ambitious, innovative ideas now have a fertile ground for growth through crowdfunding. This ground-breaking financial mechanism is, therefore, not just an innovative funding tool, but a powerful catalyst for societal change and progress.

Περισσότερα από την Crowdbase

Ανακάλυψε περισσότερα από το blog μας, οδηγούς και άλλαΜη χάσεις την επόμενη ευκαιρία

Εγγραφείτε στο newsletter μας για να ενημερώνεστε πρώτοι για νέες καμπάνιες, ενημερώσεις και πολλά άλλα!