Why a Startup Might Need Multiple Funding Rounds

Starting a business is an exciting journey, but for startups across Europe, securing funding is often the key to scaling and success. Unlike a one-time cash injection, multiple funding rounds allow businesses to adapt to evolving market conditions, refine their offerings, and strategically expand. In this article, we’ll dive deeper into the reasons startups often require multiple funding rounds, the nuances of bridge rounds, and how this process aligns with the European entrepreneurial ecosystem.

Understanding Startup Funding Rounds

Securing funding isn’t just about acquiring capital; it’s about aligning resources with strategic milestones. Let’s explore how different types of funding rounds serve various needs at each stage of a startup’s journey.

What Are Funding Rounds?

Funding rounds are categorised by the stage of the business and the purpose of the capital being raised.

- Pre-Seed and Seed Rounds:

- Pre-Seed Funding: This round is where ideas take shape. Funding is often sourced from personal savings, angel investors, or local government programs. Pre-seed funding supports concept validation, early prototyping, and business planning.

- Seed Funding: Seed funding is the financial push startups need to create a viable product or service. This stage often attracts angel investors, venture capitalists, and government grants like Horizon Europe. Startups use this funding to conduct market research, assemble a core team, and launch a minimum viable product (MVP).

Series A:

Series A funding is about scaling proven concepts. Startups use this round to refine their product, enhance marketing efforts, and expand operations. Investors expect clear metrics like user growth and revenue to ensure the business is ready for larger market penetration. European VCs like Atomico and Index Ventures frequently participate at this stage.

Series B and Beyond:

By the time startups reach Series B, they are focused on gaining significant market share. Funds are often allocated to technology upgrades, market expansion across countries, and operational efficiencies. These rounds prepare businesses to compete on a global scale.

Bridge Rounds:

Bridge rounds are interim funding rounds designed to keep startups afloat during transitional phases. Whether to cover delays in reaching profitability or to sustain operations before a larger funding round, bridge rounds often involve flexible financing like convertible loans. In the EU, these rounds are particularly useful in highly regulated industries, where external factors can delay growth timelines.

The Mechanics of Multiple Funding Rounds

Capital Requirements and Regional Nuances

In Europe, the capital requirements of startups can vary widely based on their location and industry.

- Early Stages: Startups in countries with strong public funding programs, like Germany (High-Tech Gründerfonds) or France (La French Tech), often rely heavily on grants and angel investments.

- Growth Stages: Expansion within Europe requires navigating regulatory environments, differing tax structures, and language barriers, which increases the demand for additional funding. Entering markets outside the EU adds further complexity, driving the need for significant capital reserves.

Investor Expectations and Milestones

European investors are highly focused on startups achieving measurable progress between rounds. Milestones often include:

- Achieving product-market fit.

- Demonstrating scalable revenue models.

- Meeting sustainability benchmarks, particularly in green tech or ESG-compliant industries.

Startups that can showcase strong metrics and alignment with regional market trends are more likely to secure follow-on investments.

Why Startups Often Require Multiple Funding Rounds

Market Adaptation

Europe’s fragmented market requires startups to tailor their offerings to meet regional consumer preferences and regulatory standards. For example, expanding into Germany’s healthcare market demands compliance with stringent privacy laws, while entry into Southern Europe might involve adjusting to cultural buying behaviours. Each adaptation requires resources, often sourced through successive funding rounds.

Scaling Challenges

Scaling across the EU isn’t as straightforward as expanding within a single country. Challenges include:

- Compliance: Navigating the European GDPR framework and regional labour laws.

- Localisation: Adapting products or services to multiple languages and cultural contexts.

- Logistics: Establishing cross-border supply chains and operations.

Funding rounds provide the capital needed to tackle these challenges without overburdening the startup’s cash flow.

Continuous Innovation

Europe is a global leader in sectors like clean energy, fintech, and automotive industry. To maintain competitiveness, startups must continuously innovate and respond to emerging trends. Ongoing R&D often requires substantial capital, necessitating additional funding rounds.

Bridge Rounds for Stability

Economic uncertainty, regulatory delays, or shifts in market demand can disrupt a startup’s growth trajectory. Bridge rounds act as a financial safety net, allowing startups to stay on course. For example, a fintech startup waiting for regulatory approval in a key EU market might use bridge funding to sustain operations while avoiding major disruptions.

Growth Acceleration: Raising Capital to Scale Faster

While many startups pursue funding rounds to sustain operations or achieve key milestones, some reach a point where they are cash positive and no longer need additional capital to survive. In such cases, startups may still choose to raise funds to accelerate growth—what is often referred to as achieving hypergrowth.

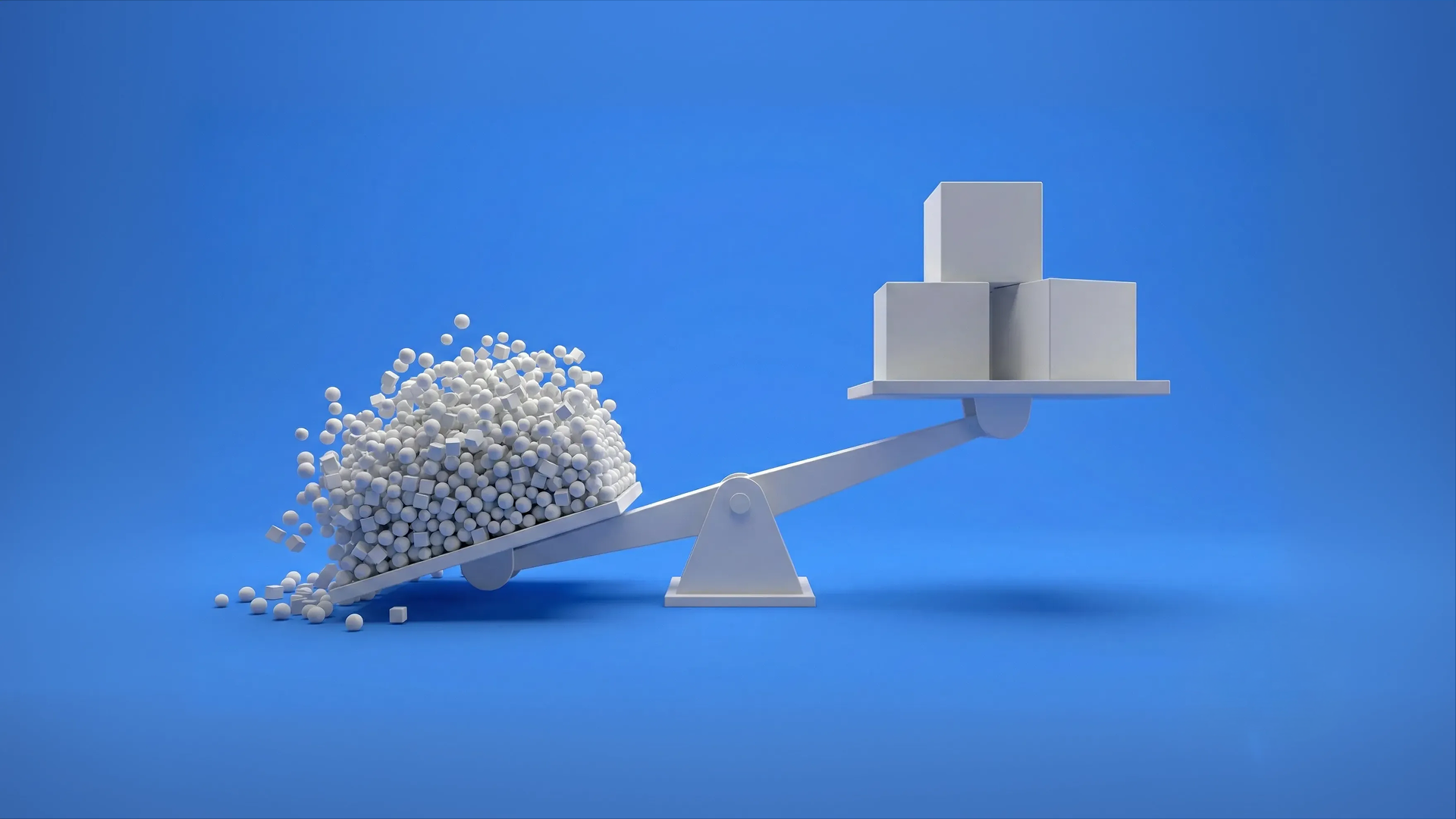

This decision hinges on balancing two competing priorities: retaining equity versus scaling at an accelerated pace. By injecting capital into areas such as expanding into new markets, increasing customer acquisition, or developing new product lines, startups can outpace competitors and capture a larger share of their market more quickly.

However, giving up equity to achieve faster growth comes with trade-offs. Founders must carefully assess whether the projected returns from scaling faster outweigh the dilution of ownership and potential control. Furthermore, this strategy requires a clear growth plan and metrics to demonstrate to investors that the additional funds will drive exponential returns.

Hypergrowth-oriented funding rounds are particularly prevalent in competitive sectors such as fintech, AI, and consumer technology, where gaining a first-mover advantage or dominating a market niche can be critical to long-term success.

The Pros and Cons of Multiple Funding Rounds

Advantages

- Strategic Growth: Multiple funding rounds align with key growth stages, ensuring that startups have the resources to execute plans effectively.

- Access to Expertise: European investors often provide strategic mentorship and introductions to networks, which can be as valuable as the capital itself.

- Market Validation: Securing successive rounds of funding signals credibility to customers, partners, and future investors.

Risks and Challenges

- Ownership Dilution: Each funding round typically requires giving up equity, which may lead to founders losing significant ownership over their company.

- Fundraising Fatigue: The effort required to pitch to investors, negotiate terms, and meet due diligence requirements can detract from operational focus.

- Regulatory Hurdles: Each round may introduce new legal and tax complexities, particularly when dealing with international investors.

Tax Implications and Legal Considerations

Navigating EU Tax Incentives

Startups in Europe benefit from various tax breaks and grants. For instance, the UK’s SEIS/EIS schemes provide tax relief for investors, while many EU countries offer R&D tax credits. However, startups must carefully manage their tax obligations, particularly when issuing employee stock options or expanding cross-border.

Legal Structures and Investor Agreements

Convertible loans are a common tool in the EU, especially in bridge rounds. They provide startups with capital while delaying the valuation process, which can be advantageous in uncertain markets. Founders must also navigate complex shareholder agreements to protect their long-term interests.

Final Thoughts

Multiple funding rounds are not just about securing capital—they’re about aligning financial resources with strategic growth milestones. For startups operating in Europe’s diverse and dynamic markets, these rounds are often essential for navigating regulatory landscapes, scaling operations, and staying competitive.

By leveraging region-specific programs, building strong investor relationships, and focusing on long-term sustainability, startups can navigate the complexities of the European funding ecosystem. While the journey may involve trade-offs, the opportunities for growth and innovation make it a worthy endeavour for ambitious entrepreneurs.

Περισσότερα από την Crowdbase

Ανακάλυψε περισσότερα από το blog μας, οδηγούς και άλλαΜη χάσεις την επόμενη ευκαιρία

Εγγραφείτε στο newsletter μας για να ενημερώνεστε πρώτοι για νέες καμπάνιες, ενημερώσεις και πολλά άλλα!