What is Debt Crowdfunding?

What is Debt Crowdfunding?

Debt crowdfunding, also known as peer-to-peer lending or crowdlending, is a financing method where businesses (usually small and medium-sized enterprises, or SMEs) raise capital by borrowing money from a large number of individual investors through an online crowdfunding platform. Unlike equity crowdfunding, where investors acquire shares in the company, debt crowdfunding involves businesses issuing debt securities (loans) to be repaid with interest.

This method of raising funds is primarily used by later-stage startups and established businesses with a financial track record. Investors lend money to the business, expecting to receive regular interest payments over a specified period and ultimately get their principal back. Debt crowdfunding offers a unique opportunity for both businesses and investors, bridging the gap that traditional financing sources (like banks) may leave behind.

How Debt Crowdfunding Works

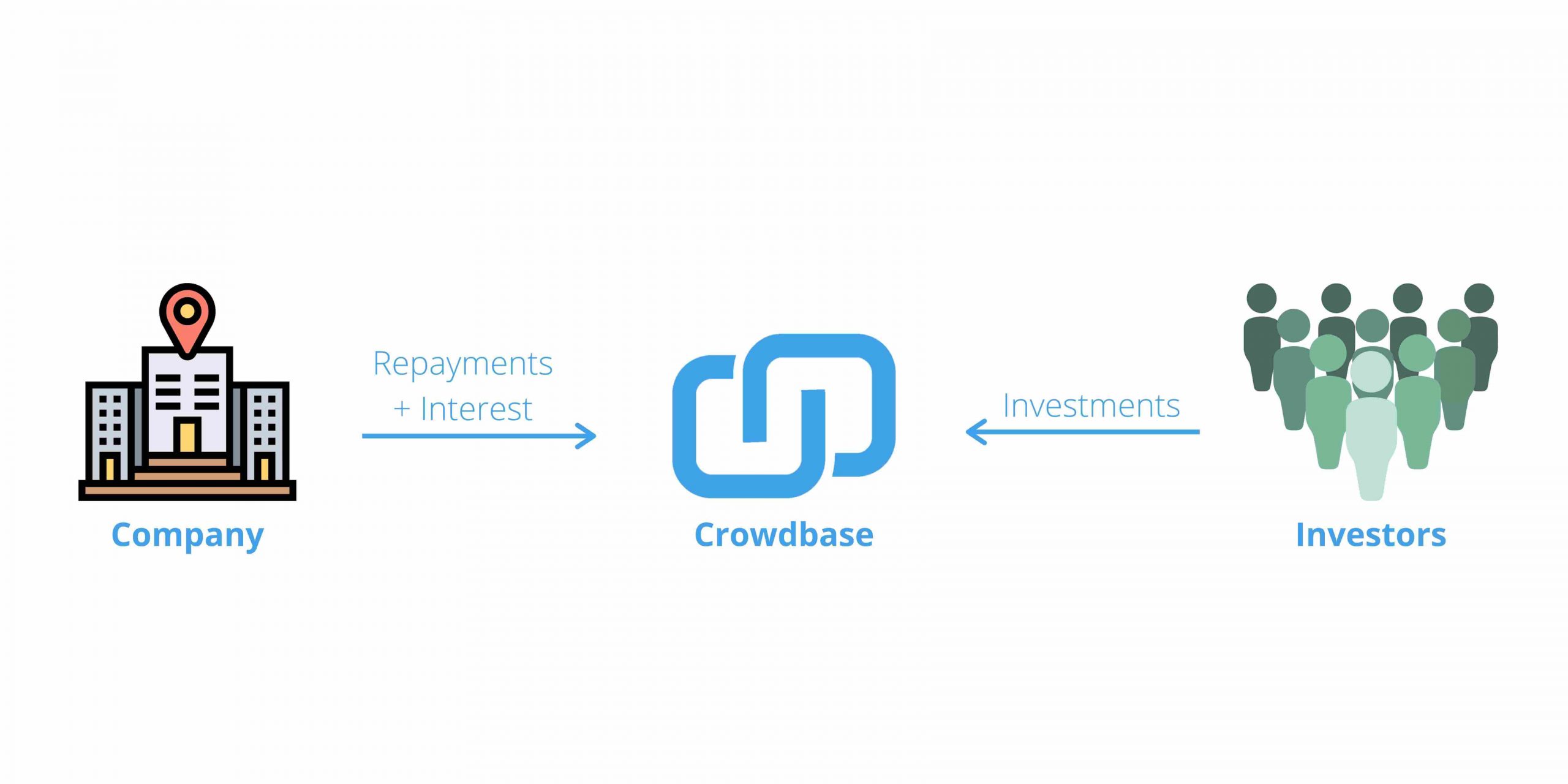

In a debt crowdfunding campaign, three main parties are involved:

- Project Owner: The project owner, typically the business or entrepreneur, is the borrower in this transaction. They are responsible for presenting their funding needs to investors through a campaign hosted on the platform. Once the campaign concludes successfully, they are obligated to repay the debt according to the terms set out in the campaign documentation.

- Investors: Investors participate by lending money to the business with the expectation of being repaid with interest over time. Before committing, they can review detailed information about the business, its financial standing, and repayment terms. After investing, they will receive regular updates and official documentation confirming their debt securities and repayment schedule.

- Platform: The platform acts as an intermediary, connecting project owners with investors. It is responsible for verifying the identity of all parties, ensuring regulatory compliance, and facilitating the transaction. The platform also helps manage the campaign, ensuring transparency and that all funds are handled securely.

The Pros and Cons of Debt Crowdfunding

As with any investment, debt crowdfunding offers both advantages and disadvantages that potential investors should consider carefully.

The Benefits of Debt Crowdfunding

- Higher Returns: Debt crowdfunding typically offers higher interest rates compared to traditional savings accounts or bonds.

- Regular Income: Investors receive predictable, scheduled interest payments and principal repayments.

- Diversification: Investors can diversify their portfolios by adding alternative investment opportunities in the form of loans to businesses, reducing overall risk.

- Asset-backed Loans: Many debt crowdfunding campaigns are secured against the company’s assets, which increases security for investors.

- Support for Local Businesses: It provides SMEs with an opportunity to secure capital and grow, boosting the local economy.

- No Equity Dilution: Businesses can raise funds without giving up any ownership or control, unlike in equity crowdfunding.

The Disadvantages of Debt Crowdfunding

- No Share in Business Success: Investors do not benefit from potential profits beyond the agreed-upon interest rate, even if the business performs exceptionally well.

- Inflation Risk: Most debt crowdfunding loans are not inflation-protected, meaning their value may decrease in real terms if inflation rises.

- Credit Risk: If a business defaults on its loan, investors may face partial or total loss of their investment.

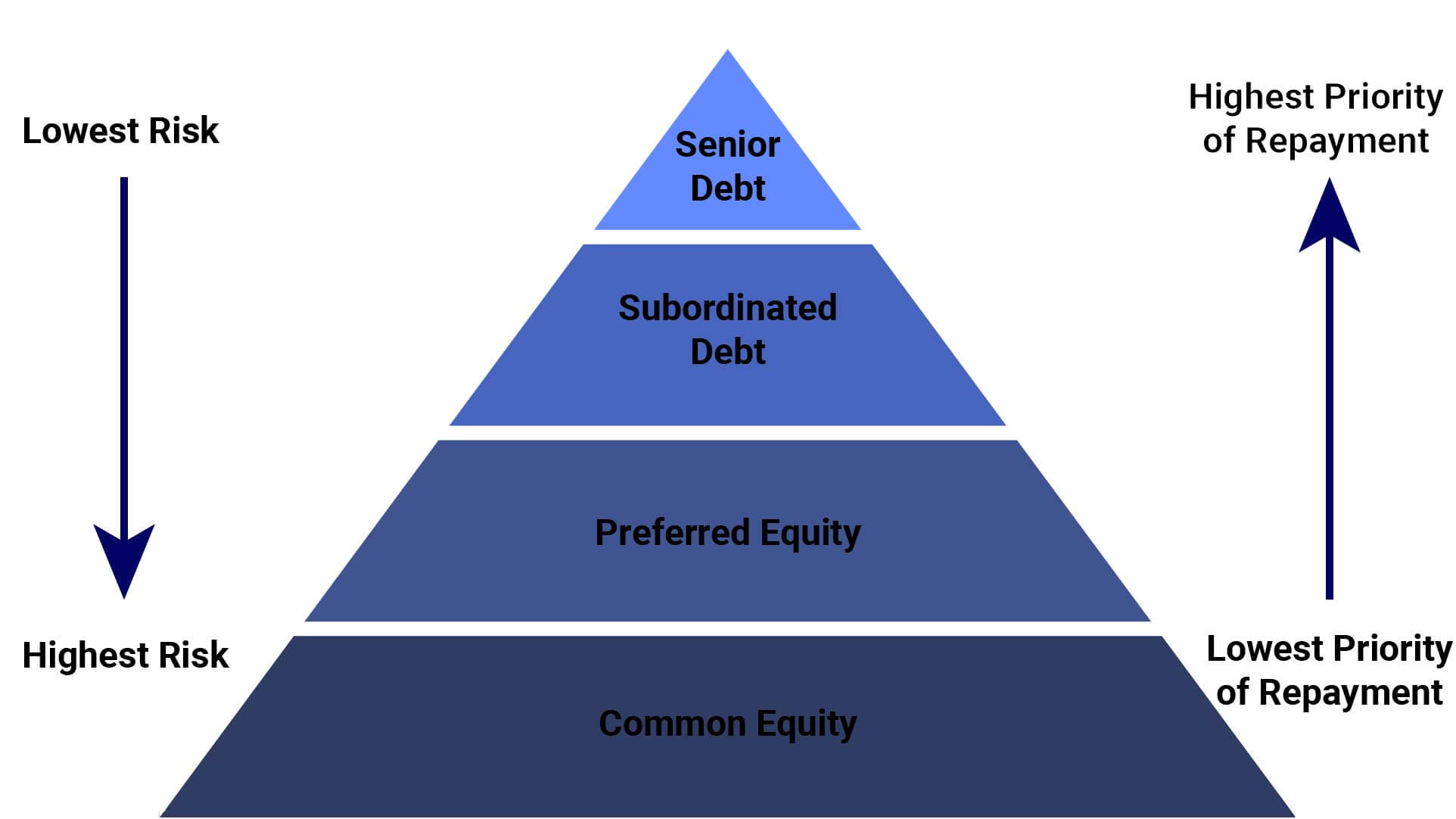

- Subordination Risk: In cases where the business raises more debt or goes into bankruptcy, debt crowdfunding investors may be ranked lower in priority for repayment.

Debt Crowdfunding vs Equity Crowdfunding

Debt crowdfunding and equity crowdfunding both provide businesses with alternative funding sources, but they differ significantly in terms of structure, risks, and investor rewards.

- Ownership: In debt crowdfunding, investors do not gain ownership in the company. They are merely creditors who expect to be repaid with interest. In contrast, equity crowdfunding investors receive company shares, which means they own a portion of the business and can benefit from its growth.

- Returns: Debt crowdfunding offers fixed, predictable returns based on the interest rate of the loan. Equity crowdfunding, however, is tied to the performance of the business and its valuation, meaning returns can be highly variable.

- Risk: Debt crowdfunding is often considered lower risk because the loan is typically secured against company assets and investors are prioritized in case of default. Equity crowdfunding, however, carries a higher risk, as investors can lose their entire investment if the business fails.

- Investor Involvement: Debt crowdfunding generally involves less direct involvement with the business. Investors do not have a say in how the company operates. Equity crowdfunding investors, however, may have voting rights and influence over business decisions.

Top Debt Crowdfunding Platforms

There are several popular debt crowdfunding platforms that facilitate lending between individuals and businesses. Some of the top platforms include:

- Funding Circle: One of the largest debt crowdfunding platforms, specializing in loans for SMEs.

- Mintos: An international marketplace for investing in loans, offering a diverse range of asset-backed investment opportunities.

- October: A platform that allows individuals to lend to French businesses, primarily SMEs.

- PeerStreet: Focuses on real estate-backed loans, allowing investors to diversify their debt crowdfunding portfolios.

Alternatives to Crowdfunding

While crowdfunding is a popular method for raising capital, there are several alternative ways for businesses to secure funding:

- Traditional Bank Loans: Businesses can apply for loans from banks or financial institutions, though these often require strong financial records and collateral.

- Venture Capital (VC): Startups with high growth potential may attract investment from venture capital firms, in exchange for equity and a share in the company’s future success.

- Angel Investors: These are individuals who provide funding to startups in exchange for equity or convertible debt. Angel investors typically offer mentorship and support to the business as well.

- Grants and Subsidies: Government bodies, NGOs, and private organizations offer grants or subsidies to businesses, often for specific purposes like innovation or sustainability.

- Invoice Financing: Businesses can sell their outstanding invoices to third-party financiers in exchange for immediate cash, bypassing traditional lending routes.

Who should invest in Debt Crowdfunding?

Debt crowdfunding is suitable for a wide range of investors, particularly those with spare capital sitting in low-interest savings accounts. With minimum investments typically starting from €100, it's accessible to many people. This investment avenue is ideal for those looking for relatively low-risk opportunities with fixed returns, without the complexities of equity investments.

It is also a good fit for investors seeking to diversify their portfolios by adding alternative assets such as business loans and bonds. However, potential investors should still assess the credit risk and ensure they understand the terms before committing.

Takeaways

Debt crowdfunding allows individuals to lend money to businesses in exchange for regular interest payments, offering higher returns than traditional savings accounts or bonds. It provides a low-risk investment opportunity, especially when loans are secured against business assets. Moreover, it offers businesses an efficient way to raise capital without giving up ownership.

However, like any investment, debt crowdfunding carries risks, including the potential for business default. It is essential to conduct thorough research and understand the terms before committing funds.

Περισσότερα από την Crowdbase

Ανακάλυψε περισσότερα από το blog μας, οδηγούς και άλλαΜη χάσεις την επόμενη ευκαιρία

Εγγραφείτε στο newsletter μας για να ενημερώνεστε πρώτοι για νέες καμπάνιες, ενημερώσεις και πολλά άλλα!