Types of Crowdfunding: A Comprehensive Guide for Startups and Businesses

Introduction

Crowdfunding has evolved into a powerful tool for startups and small businesses, especially in Europe, offering an alternative to traditional financing methods such as bank loans or venture capital. In fact, European crowdfunding platforms raised over €6 billion in 2023 alone, showcasing the growing demand for this innovative funding model. Whether you're launching a new product or seeking capital for expansion, crowdfunding can help you tap into a global pool of backers eager to support your vision.

For businesses operating within the European Union (EU), understanding the different types of crowdfunding and the region’s regulatory landscape is more crucial than ever. With regulations like the EU Crowdfunding Regulation (ECSPR), which standardises rules across EU member states, it has become easier for startups to conduct cross-border campaigns. This means that businesses can access a larger investor base across Europe, with fewer regulatory barriers, ensuring smoother and more efficient fundraising processes.

Understanding Crowdfunding

What is Crowdfunding?

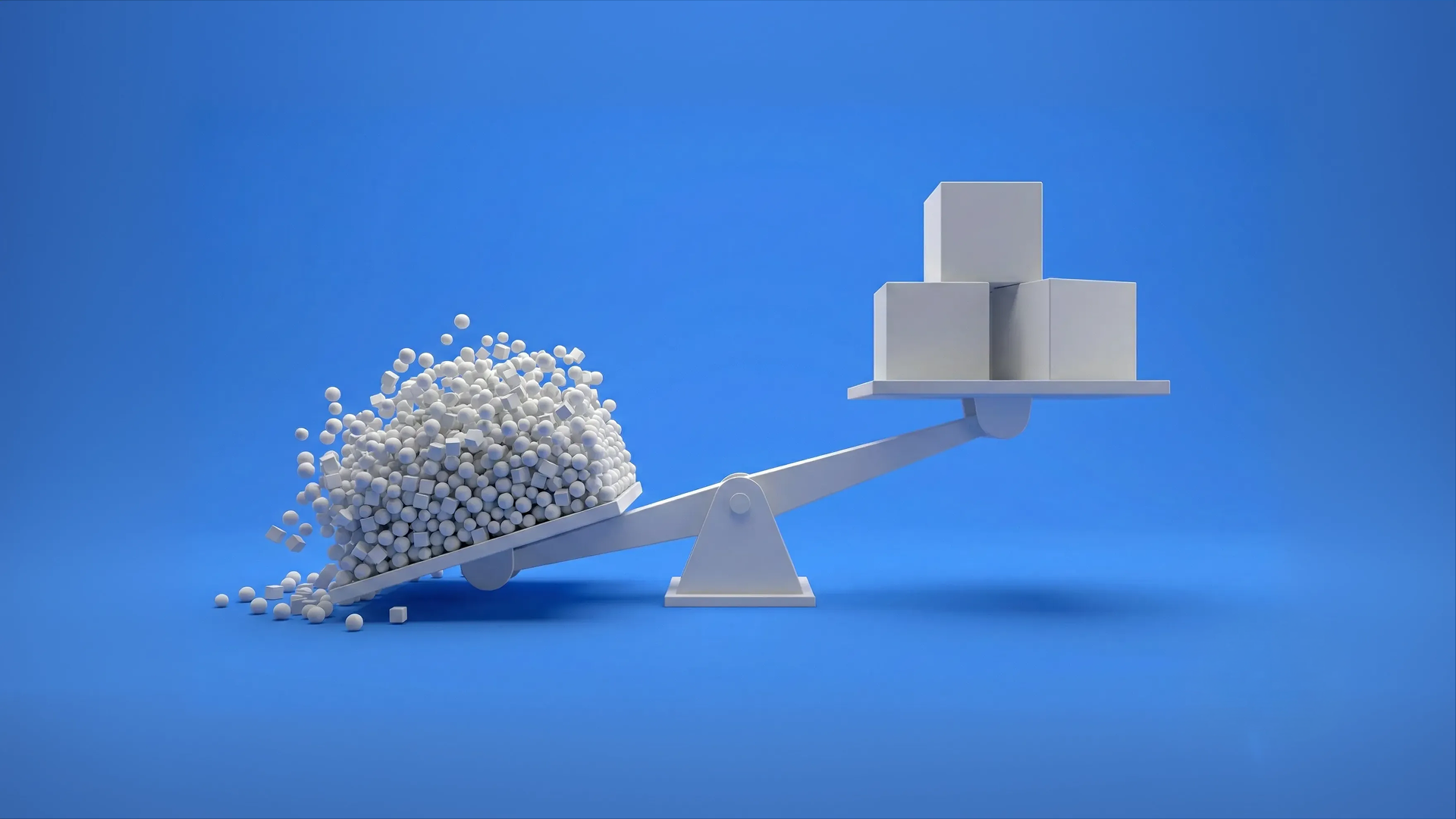

Crowdfunding is the practice of raising small amounts of capital from a large number of people, typically via online platforms. Unlike traditional funding methods, crowdfunding democratises the funding process by enabling entrepreneurs to connect directly with a wide range of backers. This not only provides capital but also offers valuable community validation for new ventures.

The Evolution of Crowdfunding in Europe

Crowdfunding in Europe has grown rapidly, fuelled by the rise of digital platforms and supported by favourable legislation. The EU Crowdfunding Regulation (ECSPR), introduced in 2021, is a key development in this landscape. By standardising rules across the region, the ECSPR has simplified cross-border crowdfunding, making it easier for startups to raise capital from investors across different EU member states.

The Four Main Types of Crowdfunding

Crowdfunding in Europe can be broadly categorised into four main models, each suited to different business needs.

Equity Crowdfunding

Equity crowdfunding allows businesses to raise funds by offering shares or equity stakes to investors. In return for their capital, investors receive a portion of the business ownership. This model is particularly attractive to startups seeking large investments for growth and expansion. Platforms such as Crowdbase and Crowdcube operate under EU-wide regulations, which makes it easier for businesses to raise funds from investors across borders, benefitting from the increased investor pool.

Rewards-Based Crowdfunding

Rewards-based crowdfunding provides non-financial incentives, such as early access to products or exclusive perks, in exchange for financial support. This model is ideal for businesses launching innovative consumer products, allowing them to validate demand and generate early-stage funding. Popular platforms like Kickstarter and Indiegogo have helped countless startups bring their ideas to life by engaging a broad, enthusiastic audience.

Donation-Based Crowdfunding

Donation-based crowdfunding is primarily used for social causes or charitable initiatives, where backers contribute without expecting any financial return. Platforms such as GoFundMe focus on raising funds for causes that support community, health, or social good. This model typically involves minimal regulatory requirements compared to equity crowdfunding, making it more accessible for smaller projects or non-profits.

Debt Crowdfunding (Peer-to-Peer Lending)

Debt crowdfunding connects businesses with individual lenders who provide loans that must be repaid with interest. This model is often more accessible than traditional bank loans, especially for companies with predictable cash flows. Platforms like Funding Circle and Mintos allow businesses to secure loans from a broad pool of investors, providing a flexible financing option that doesn’t require giving up equity.

Niche Types of Crowdfunding

Europe’s diverse market has also led to the emergence of niche crowdfunding models that cater to specific industries or audiences.

Real Estate Crowdfunding

Real estate crowdfunding democratises access to the property market by allowing developers to raise funds from small investors. This model has become particularly popular in Europe, where regulations support cross-border investment. Real estate platforms like EstateGuru and CrowdProperty have enabled investors to participate in property ventures with lower entry barriers, offering developers an alternative to traditional funding sources. This approach broadens the pool of potential investors and allows businesses to tap into a larger network of backers.

Royalty-Based Crowdfunding

Royalty-based crowdfunding appeals to businesses in creative industries, such as music, film, and publishing, by offering backers a share of future revenues in exchange for their support. Platforms like SongVest have successfully connected musicians with fans who are eager to invest in future royalties. This model is well-suited to Europe’s thriving cultural industries, where backers are passionate about supporting the arts and seeing a return on their investment.

How to Choose the Right Type of Crowdfunding

Choosing the right crowdfunding model can significantly impact the success of your campaign. This decision depends on a strategic understanding of your business stage, funding needs, target audience, and market environment.

1. Understand Your Business Stage and Goals

The stage your business is in plays a key role in determining the most appropriate crowdfunding model. For early-stage businesses, rewards-based crowdfunding is an excellent choice. It allows you to validate your product idea, build an early customer base, and raise initial funds without giving up equity. This model is particularly effective for consumer-focused products, as it appeals to individuals who are excited to support innovation.

If you're a growth-stage startup looking to scale, equity crowdfunding could be more suitable. By offering shares, you can raise significant capital while allowing investors to participate in the company’s success. Established businesses with stable cash flows may find debt crowdfunding more fitting, as it provides funds without diluting ownership.

2. Assess Your Funding Needs and Audience

Consider both the amount of funding you need and the type of audience you want to engage. Rewards-based crowdfunding works well for smaller projects or those that can offer appealing non-financial rewards to backers. If your goal is to raise larger sums, equity crowdfunding may be the right fit, as it opens access to investors with the capital to support your growth.

Understanding your audience is also crucial. Rewards-based crowdfunding appeals to backers who are emotionally invested in your product or cause. In contrast, equity and debt crowdfunding attract individuals or institutions seeking financial returns. Donation-based crowdfunding is ideal for social or charitable causes, focusing on backers who are motivated by altruism.

3. Tailor Your Model to Your Product or Service

Finally, think about how your product or service aligns with specific crowdfunding models. Consumer products, such as gadgets or fashion items, are a natural fit for rewards-based crowdfunding, while businesses in B2B or technology sectors may lean towards equity or debt crowdfunding for long-term growth. Royalty-based crowdfunding suits creative projects that can generate consistent future revenues, such as music, films, or even digital content.

Maximising Crowdfunding Success

A successful crowdfunding campaign requires preparation, strategic planning, and consistent engagement with backers.

Preparing for a Crowdfunding Campaign

Set clear, realistic goals for your campaign. Avoid overestimating your funding targets, as this can discourage potential backers. Craft a compelling pitch that highlights your unique value proposition and connects emotionally with your audience. Consider offering a mix of rewards to cater to both small and large contributors.

Launching and Managing Your Campaign

During the campaign, promotion is key. Use social media platforms like Instagram and LinkedIn to share updates, behind-the-scenes content, and news. Engage with your backers by responding promptly to questions and comments, maintaining transparency throughout the process.

Post-Campaign Success

After the campaign ends, ensure that you deliver on promises—whether that means shipping rewards, offering equity updates, or repaying debt. Keep your backers informed of your progress, turning them into long-term supporters and advocates for your business.

Legal and Financial Considerations

Crowdfunding in the EU is regulated by the EU Crowdfunding Regulation (ECSPR), which harmonises rules for platforms across member states. Businesses must also be aware of local regulations, such as VAT on rewards or tax implications from equity fundraising. Consulting legal and financial advisors is essential to ensure full compliance with EU laws and local tax obligations.

Final Thoughts

Crowdfunding provides a dynamic and inclusive way for startups and small businesses in Europe to secure funding. By choosing the right model, preparing thoroughly, and engaging effectively with backers, businesses can tap into a diverse network of supporters and investors. As Europe’s crowdfunding landscape continues to evolve, entrepreneurs have more opportunities than ever to leverage this innovative funding method to grow and scale their businesses.

Συχνές Ερωτήσεις

Περισσότερα από την Crowdbase

Ανακάλυψε περισσότερα από το blog μας, οδηγούς και άλλαΜη χάσεις την επόμενη ευκαιρία

Εγγραφείτε στο newsletter μας για να ενημερώνεστε πρώτοι για νέες καμπάνιες, ενημερώσεις και πολλά άλλα!