What is Equity Crowdfunding?

Frixos Larkos

Co-Founder & CEO

Equity Crowdfunding Overview

Equity crowdfunding is a method of raising money from many individuals (the crowd), primarily used by startups and Small and Midsize Enterprises (SMEs). In exchange for their money, the companies issue equity securities (shares) to investors. The investors receive their ownership stake in the company, proportional to their investment, and according to the company’s valuation.

Among the many types of crowdfunding campaigns, equity crowdfunding is the one with the highest potential for financial returns. While other crowdfunding types have predetermined rewards and limited upside potential, equity crowdfunding returns can theoretically be unlimited. Consequently, it is also the type that has the highest risk.

How Equity Crowdfunding Works

There are three parties involved in every equity crowdfunding transaction. See below who those parties are and what each one does.

- Project Owner: As the host of the campaign, the project owner is the entity seeking to raise capital from investors. Once their campaign is live, they are responsible for investors’ queries about the company and transferring the securities to investors once the campaign is successfully completed. They must also carry out the investment objectives as stated in the Key Investor Information Sheet (KIIS) on the campaign’s page.

- Investors: As backers of the campaign, investors commit their capital to the project in exchange for a share of ownership. Before investing, they can find all the information they need on the campaign’s page, as well as ask more questions directly to the project owner. After investing, they receive a certificate of ownership and become proud owners of a business they believe in.

- Platform: As a mediator, the platform is where project owners and investors come together. The platform acts as a neutral intermediary, facilitating the exchange of funds and ownership between project owners and investors. It is responsible for ensuring the quality and authenticity of investment opportunities and advertising available deals to the crowd. Additionally, it ensures that project owners’ and investors’ identities are verified, and all regulatory standards are followed. Lastly, the platform is also responsible for collecting funds from investors and safekeeping them with a reputable financial institution.

How to Invest in Equity Crowdfunding

Crowdbase offers individuals the chance to invest in revolutionary and exciting businesses and become proud owners. You can do this by following these easy steps:

- Create an account and complete the required identity verification process (which takes less than 10 minutes).

- Browse our roster of current investment opportunities and choose the ones that fit your liking.

- Decide how much you want to invest in each campaign.

- Once the campaign is successfully completed, receive your certificate of ownership.

- Enjoy financial rewards if the business succeeds!

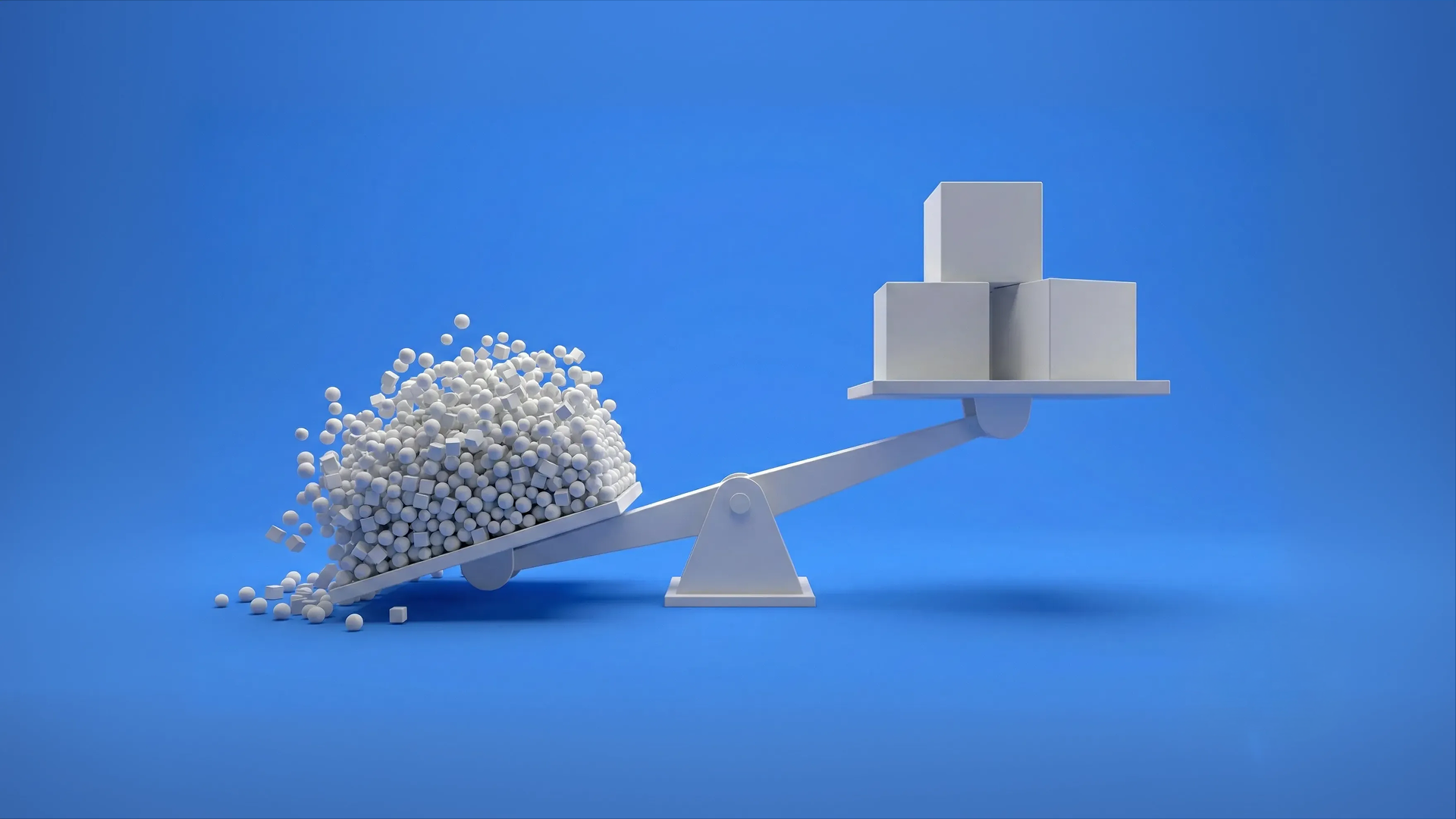

The Pros and Cons of Equity Crowdfunding

Investing in equity crowdfunding, like investing in any other asset class, comes with its own advantages and disadvantages. Therefore, before investing, it’s important to educate yourself on the rewards you can expect, but also any potential risks.

The Benefits of Equity Crowdfunding

- It can offer unlimited upside potential if you can spot the winners and invest early.

- Access to highly lucrative investment opportunities, previously only available to professional investors.

- Offers investors the opportunity to invest in businesses or ideas they resonate with, and be part of their journey.

- It makes it easier for startups and SMEs to secure funding, fostering growth in the local economy.

- Allows businesses to raise capital without giving up control to venture capital investors.

The Disadvantages of Equity Crowdfunding

- Has the highest risk among all crowdfunding types, as equity holders are the lowest in seniority. In a bankruptcy scenario, equity holders usually suffer a significant percentage loss on their investment.

- It usually takes a long time before receiving any financial rewards, if at all.

- If the business raises more capital after you invest, your ownership stake can be diluted.

- Difficult to spot winners from the start.

Who should invest in Equity Crowdfunding?

As is the case with the other investment opportunities on our platform, anyone can invest in equity crowdfunding. Minimum and maximum investments may vary by campaign, but in most cases, you can invest from as little as €100! As mentioned above, equity crowdfunding is considered a high-risk investment, so make sure you understand the risks before you invest.

Takeaways

To sum up, equity crowdfunding gives investors the opportunity to invest in promising and exciting private businesses. While in the past, these opportunities were only accessible to professional investors, now they are accessible to everyday individuals.

You can invest in socially impactful projects and become a part of their journey, from as little as €100! Equity crowdfunding offers the potential for outsized returns, but like any other investment, it comes with its own risks.

Περισσότερα από την Crowdbase

Ανακάλυψε περισσότερα από το blog μας, οδηγούς και άλλαΜη χάσεις την επόμενη ευκαιρία

Εγγραφείτε στο newsletter μας για να ενημερώνεστε πρώτοι για νέες καμπάνιες, ενημερώσεις και πολλά άλλα!