Equity Crowdfunding in Europe: The Complete 2025 Guide

Equity crowdfunding has become a cornerstone of the European innovation ecosystem, opening up startup investing for founders and everyday investors alike. Whether you’re launching the next disruptor or looking to diversify your portfolio, this is your all-in-one guide to equity crowdfunding Europe in 2025, covering regulations, platforms, regional insights, and how Crowdbase empowers your success.

What Is Equity Crowdfunding?

Equity crowdfunding allows startups and small businesses to raise capital online by selling new shares to a large number of investors. Unlike donation-based or rewards-based crowdfunding, where backers receive perks or recognition, investors in equity crowdfunding gain an ownership stake and share in the startup’s potential upside.

How it differs from other models:

- Donation-based: Supporters donate without financial returns.

- Rewards-based: Backers receive a product or perk, not equity.

- Equity crowdfunding: Investors receive shares and own part of the company.

Comparison with Angel Investing and Venture Capital:

- Angel/VC: Typically restricted to high-net-worth individuals or funds, often requiring large minimum investments and significant influence on startup decisions.

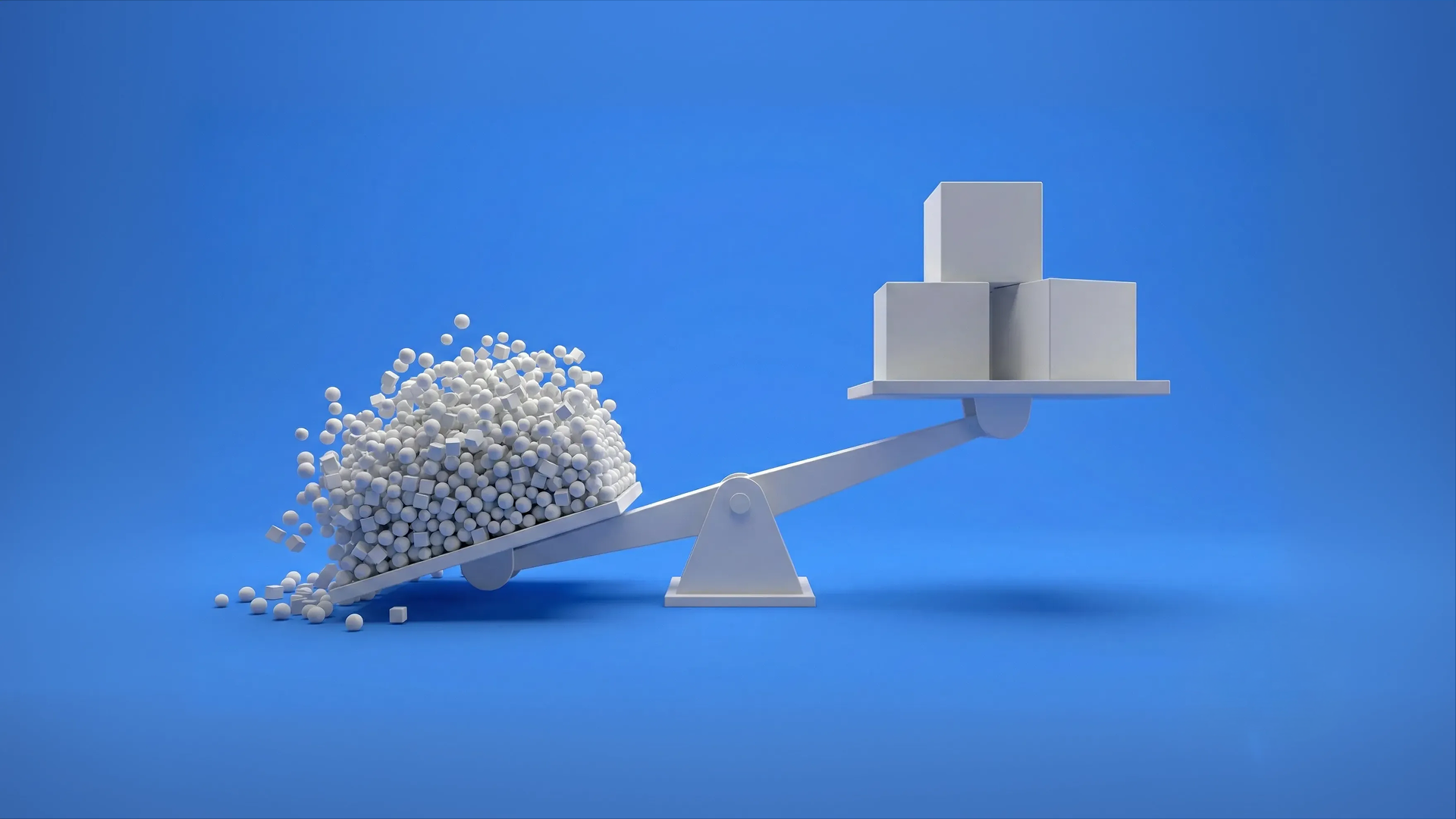

- Equity crowdfunding: Open to a broader pool of investors, often with investments from €100 and up, with less influence per investor, democratising access to early-stage opportunities.

Why Equity Crowdfunding Is Growing in Europe

The popularity of equity crowdfunding in Europe is booming. Trends fueling this surge include:

- Market growth: Europe accounts for 30% of the global equity crowdfunding volume, with the market estimated at $2.1 billion in 2025 and projected to more than double by 2032 (thegeca, 2025).

- Regulatory harmonisation: The European Crowdfunding Service Providers Regulation (ECSPR) enables cross-border investment, increasing pan-European capital flows and standardising investor protections.

- Startup adoption: Crowdbase alone saw over €2 million raised in 2025, spanning diverse sectors in Greece and Cyprus, mirroring strong regional momentum.

Success stories:

- Crowdbase’s Ask Wire campaign raised €539,720 from 274 investors in Cyprus, setting national records for both amount and participation.

- International platforms such as Republic Europe and Crowdcube have facilitated funding rounds surpassing 1 billion GBP in Europe, underpinning growth across the continent.

Regulation & Licensing Across the EU (ECSPR)

The European Crowdfunding Service Providers Regulation (ECSPR), in force since 2021, harmonises rules for both investment- and lending-based crowdfunding. The core elements include:

- A unified funding threshold of up to €5 million per project per year.

- Standardised disclosure, due diligence requirements, and governance protocols for platforms and campaigns.

- Mandatory investor protection measures, including risk warnings and conflict resolution processes.

The impact: ECSPR has catalysed cross-border deals, reduced operational uncertainty, and built investor confidence. National implementation may vary, but platforms like Crowdbase have achieved full licensing, allowing them to serve startups and investors across the EU efficiently.

Benefits of Equity Crowdfunding (For Startups and Investors)

For Startups

- Access to pan-European capital: Tap into a pool of investors across the EU, not limited to local networks.

- Brand visibility and community building: Turn backers into brand ambassadors and lifelong supporters.

- Concept validation: A successful campaign is the perfect proof of concept and validation of a potential market for your product or service.

- No debt or restrictive covenants: Unlike loans, there’s no repayment pressure, and terms are generally founder-friendly compared to some VC structures.

For Investors

- Early-stage access: Investors can back innovative startups previously reserved for VCs or private networks.

- Portfolio diversification: Invest smaller amounts across multiple sectors, geographies, and companies.

- Regulated platforms & protections: ECSPR ensures greater transparency, standardised disclosures, and dispute resolution.

- Tax incentives: Potential tax incentives on your investment (Subject to each case and country of investment)

How It Works (Step-by-Step for Founders and Investors)

For Startups

- Prepare your pitch: Craft a compelling pitch deck, business plan, and financial projections.

- Apply to a platform: Submit your company’s details to a licensed provider (e.g., Crowdbase).

- Launch your campaign: Agree on terms (valuation, minimum/maximum raise, share class) and market your offering.

- Promote and engage: Activate your network, leverage platform marketing, and build buzz.

- Close the round and onboard investors: Comply with legal documentation and onboarding steps.

For Investors

- Sign up: Join a regulated crowdfunding platform.

- Complete KYC/AML checks: Platforms conduct identity verification per EU regulations.

- Discover opportunities: Browse detailed startup profiles, financials, and campaign materials.

- Invest: Commit funds, review terms, and monitor campaign progress.

- Receive updates: Stay informed about your investments through regular company reports.

Top Equity Crowdfunding Platforms in Europe

Below is a comparison of the leading platforms supporting startups and investors across the continent:

| Platform | HQ/License | Sectors | Min. Investment | Secondary Market | ECSPR |

|---|---|---|---|---|---|

| Crowdbase | Cyprus/EU | Tech, Proptech, Real Estate, Wellness | €100 | Planned | Yes |

| Republic Europe | UK/EU | Broad/All | €10 | Yes | Yes |

| Crowdcube | UK/EU | Broad/All | €10 | Yes | Yes |

| Invesdor | DACH/Nordics | Startups, SMEs | €250 | No | Yes |

| WiSeed | France | Tech, Impact, Real Estate | €100 | No | Yes |

Crowdfunding Across Europe: Regional Insights

The most recent official data from the European Securities and Markets Authority (ESMA) provides a comprehensive snapshot of the European crowdfunding market under the European Crowdfunding Service Providers Regulation (ECSPR). In 2023, over €1 billion was raised through crowdfunding across the EU, based on a survey of 98 licensed service providers across 17 EU member states (Eurocrowd, 2025). The sector demonstrates vibrant growth and increasing harmonisation, but with notable regional flavours and strengths.

Funding Models and Investment Patterns

- Loan-based crowdfunding accounted for the majority of capital raised (65%), with debt-based (17%) and equity-based crowdfunding (6%) following.

- The average raise per project was significantly higher for debt-based (€53,000) and equity-based (€46,000) crowdfunding than for loan-based projects (€15,000).

- About 87% of investors were classified as retail, investing smaller amounts compared to sophisticated or professional investors.

- Cross-border investments, the essence of ECSPR, now represent 17% of all crowdfunding activity across the EU.

Regional Standouts

- France is the leading hub, both in capital raised and number of crowdfunding platforms. The country’s mature regulatory environment and ecosystem led to approximately a third of total EU crowdfunding capital being raised through French platforms, especially for professional, scientific, and technical services.

- Netherlands stands out as the second-largest market by both funds raised and number of licensed platforms, building on years of established regulatory frameworks.

- Other notable markets include Austria and Estonia, both of which attract significant foreign (cross-border) investment due to platform quality and regulatory clarity.

- Spain and Germany are not as heavily covered in the current ESMA dataset, but both are recognised as rapidly maturing markets with increasing ECSPR adoption and platform consolidation.

- Greece and Cyprus: While not among the largest overall by volume, these markets are experiencing rapid growth in platform activity and cross-border funding, supported by new national adoption of ECSPR and strong early-stage participation in sectors like real estate and technology.

Leading Sectors and Investor Trends

- The professional, scientific and technical services sector received the largest share of crowdfunding capital (33%), followed by construction and real estate (21%).

- Most investors remain retail, highlighting crowdfunding’s democratising effect, especially in newer or smaller EU markets.

- As regulatory regimes mature, secondary markets and cross-border opportunities are expected to accelerate, reducing national silos and levelling the playing field for smaller markets and platforms.

In summary, while ECSPR has laid the groundwork for single-market, cross-border crowdfunding, the landscape in 2025 is defined by strong national ecosystems in France, the Netherlands, and Lithuania, alongside rising activity in Greece, Cyprus, and the Baltics. The market continues to shift towards greater cross-border financial flows, deeper investor pools, and a growing role for equity crowdfunding as platforms and investors adapt to unified European standards.

Greece

- Ecosystem: Driven by local family businesses, tech hubs, and government support via funds like EquiFund.

- Incentives: National startup initiatives and government VC funds bolster co-investment.

- Regulation: ECSPR now enables Greek startups to tap pan-EU investors via platforms like Crowdbase.

→ Explore: Crowdfunding in Greece

Cyprus

- Fintech leadership: Proactive regulatory climate, robust compliance standards, and the rise of specialised platforms (Crowdbase, among others).

- Incentives: Startup incentives include tax breaks and grant schemes.

- Market maturity: Cyprus’s startup scene is accelerating, with crowdfunding playing a pivotal role in tech, real estate, and sustainability sectors.

→ Explore: Crowdfunding in Cyprus

Why Choose Crowdbase?

- Fully licensed under ECSPR: Invest and raise with confidence, Crowdbase meets all pan-EU regulatory requirements.

- Built for cross-border funding: Seamlessly connect with backers across Europe; no barriers, just opportunities.

- Startup & investor focused tools: Robust due diligence, transparent reporting, and expert campaign support.

- Track record of success: €2.5 million+ raised for startups in Greece & Cyprus, with campaign records and satisfied user testimonials.

- We invest alongside you: Aligning our goals with yours.

Ready to take your next step?

Start raising or investing with Crowdbase today.

Conclusion

Equity crowdfunding is reshaping European innovation, bridging the gap between brilliant founders and engaged investors no matter where they are in the EU. With platforms like Crowdbase, the process is simpler, and more impactful than ever before.

- For founders: [Launch a Campaign]

- For investors: [Browse Opportunities]

Ready to grow, support, and invest with confidence? Join the European equity crowdfunding movement with Crowdbase.

Περισσότερα από την Crowdbase

Ανακάλυψε περισσότερα από το blog μας, οδηγούς και άλλαΜη χάσεις την επόμενη ευκαιρία

Εγγραφείτε στο newsletter μας για να ενημερώνεστε πρώτοι για νέες καμπάνιες, ενημερώσεις και πολλά άλλα!