Crowdfunding vs VC: Which is Right for Your Startup?

Introduction

Finding the right funding source is crucial for startup success. Equity crowdfunding and venture capital (VC) are two prominent options, each with distinct benefits and considerations. Understanding these can help founders choose the best path or combine both effectively.

What Is Crowdfunding?

Crowdfunding allows startups to raise more flexible amounts of money from many investors, typically via online platforms. It opens access to capital beyond traditional investors, often providing market validation, community support, and brand building. Additionally, crowdfunding offers flexibility and usually involves less control dilution compared to VC funding.

What Is Venture Capital?

Venture capital involves professional investors or funds investing larger sums into startups they believe have very high growth potential and scalability. VCs often require significant equity, a seat at the company's decision-making table, and expect potential returns of 10x or more within a defined timeframe. This high return threshold exists because VCs expect most portfolio companies to fail, as they need the few winners to compensate for losses across the entire fund.

Different VC firms have specific investment mandates. Some focus on particular stages (seed, Series A, growth), others specialise in industries (fintech, biotech, SaaS), and many have geographical preferences. Finding the right VC fit requires understanding these criteria.

This type of funding provides not just capital but also mentorship, strategic guidance, and networks, all critical for rapid growth.

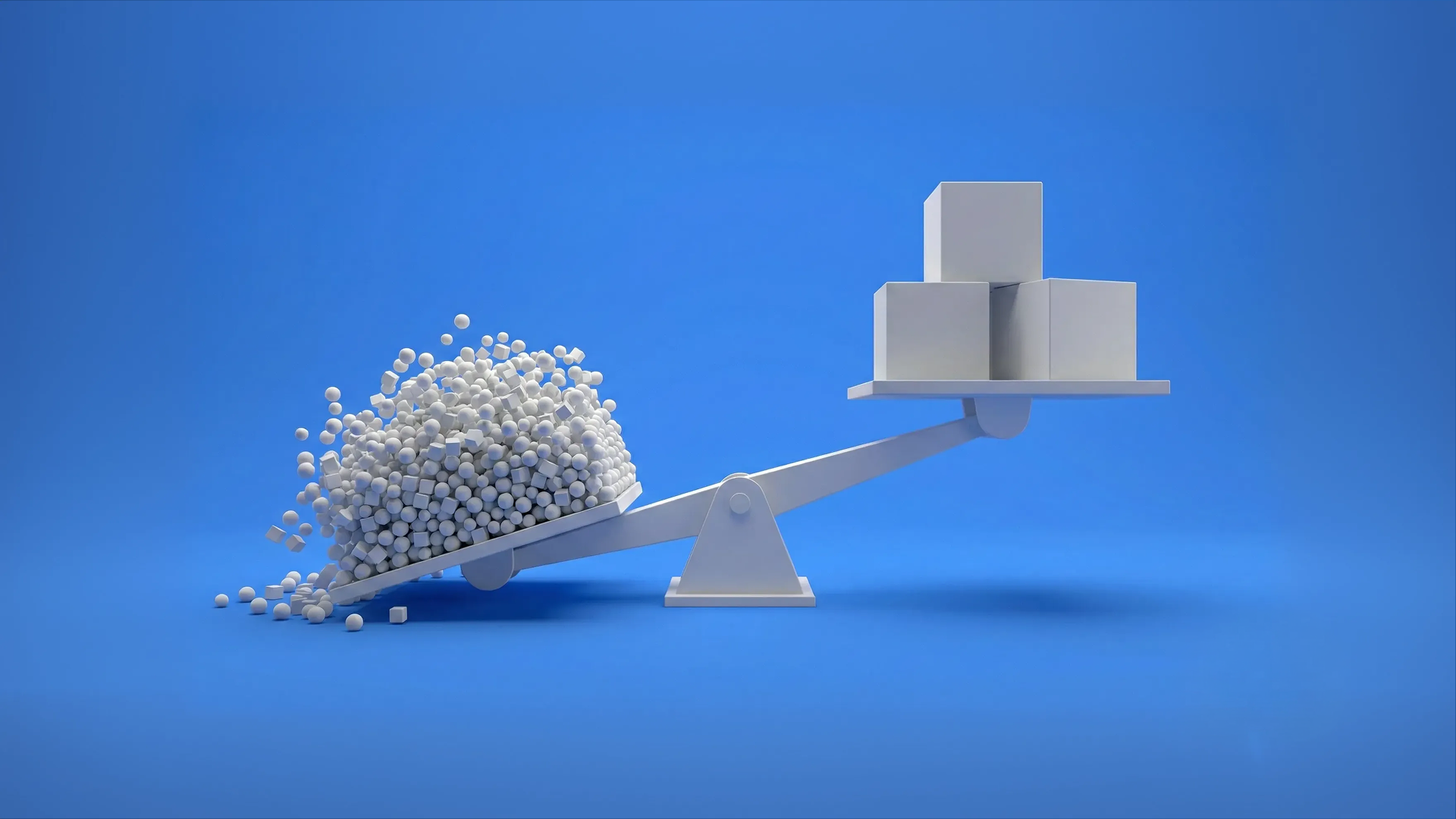

Key Differences

Crowdfunding offers more democratised access to capital with many small investors and suits startups looking for early-stage validation and moderate funding with limited equity dilution. Venture capital targets startups with proven business models capable of substantial scaling, often demanding more control and significant ownership stakes in return for large capital infusions.

Decision-making power is another major distinction. Crowdfunding campaigns are controlled primarily by the startup, deciding timing, terms, and strategy. With VC funding, decision power is shared with investors who actively shape company strategy and governance.

Crowdfunding capital is usually available quickly after a campaign, while VC funds are often disbursed in tranches tied to milestones. Crowdfunding campaigns also serve as a marketing tool, building a base of loyal customers, investors, and advocates, thereby generating ongoing value beyond the investment itself.

When Crowdfunding Makes Sense

Crowdfunding is best suited for startups seeking to:

- Validate their product or business idea through real customer interest.

- Engage directly with a community of supporters who can become customers and brand ambassadors.

- Raise flexible amounts of capital without giving away substantial equity or control.

- Access a broader investor base including retail and angel investors.

This approach can fit ventures less likely to meet the stringent scalability and growth expectations set by VCs.

When Venture Capital Fits

Venture capital is ideal for startups that:

- Have a scalable business model with potential for exponential growth.

- Seek substantial funds to accelerate product development, market expansion, and operational scaling.

- Are prepared to share significant control with investors who bring strategic input.

- Meet VC criteria, often including the potential to return at least 10x the investment, making them attractive for large-scale funding rounds.

This route works well for startups in capital-intensive sectors or those targeting large global markets.

Combining Crowdfunding and VC

Many startups benefit from a hybrid funding approach. Early-stage companies can use crowdfunding to prove market demand, build a community, and raise initial capital. This can de-risk the business and make it more attractive to VC investors later. Conversely, some startups secure VC funding initially for rapid growth and later turn to crowdfunding to expand their investor base, engage customers directly, or fund specific projects.

Startups can also combine both in a single funding round, raising capital from VCs alongside a crowdfunding campaign. This approach allows founders to secure institutional backing while maintaining community engagement and broadening their cap table.

This combined strategy leverages the strengths of both funding types, balancing control, capital needs, risk, and growth ambitions. It offers founders flexibility and multiple avenues to support their startup journey.

Conclusion

Choosing between crowdfunding and venture capital depends on your startup's growth stage, capital needs, and strategic goals. VC funding delivers large sums, expertise, and networks but demands high scalability and equity trade-offs. Crowdfunding democratises access, supports early validation, and keeps control closer to founders but generally involves smaller sums.

A blended funding approach often works best, starting with crowdfunding to validate and build community, followed by VC to scale aggressively. This ensures startups can tailor funding pathways to their unique circumstances, maximising their chances of success.

Crowdbase is here to support startups at every stage, offering a compliant equity crowdfunding platform designed for European founders and investors. Learn more about launching a crowdfunding campaign or exploring startup investment opportunities on our platform.

Περισσότερα από την Crowdbase

Ανακάλυψε περισσότερα από το blog μας, οδηγούς και άλλαΜη χάσεις την επόμενη ευκαιρία

Εγγραφείτε στο newsletter μας για να ενημερώνεστε πρώτοι για νέες καμπάνιες, ενημερώσεις και πολλά άλλα!