How ECSPR Will Affect Equity Crowdfunding in 2026

Introduction

The European Crowdfunding Service Providers Regulation (ECSPR) has been shaping the equity crowdfunding landscape across Europe since its adoption in 2021. As we approach 2026, the impact of ECSPR continues to deepen, influencing how platforms operate, how investors are protected, and how startups access capital. Understanding these effects is essential for startups, investors, and crowdfunding platforms navigating the EU market.

What Is ECSPR?

ECSPR is a comprehensive regulatory framework designed to harmonise crowdfunding rules across EU member states. It applies to platforms facilitating funding through the issuance of transferable securities up to €5 million in a 12-month period. The regulation aims to create a unified market, improve transparency, and enhance investor protection while fostering innovation in startup financing. For more on ECSPR’s provisions, see the European Digital Finance Association’s ECSP Position Paper.

Licensing and Compliance Requirements Under ECSPR

To operate legally under ECSPR, crowdfunding service providers must obtain an ECSP license from their national competent authority. This licensing enforces strict governance, minimum capital requirements (at least €25,000 or a portion of operating expenses), and professional standards for management. Platforms are required to maintain robust risk management, anti-money laundering controls, cybersecurity, and ensure transparent investor disclosures. These stringent requirements help build trust, but have raised operational challenges, especially for smaller platforms.

How ECSPR Enhances Investor Protection

ECSPR increases investor safeguards through mandatory disclosure of key investment information before any commitment. Platforms must act honestly, fairly, and professionally, avoiding conflicts of interest such as owning shares in crowdfunded projects they host. It also imposes risk warnings, caps on individual investments based on financial situations, and requires secure handling of client funds. These measures collectively raise confidence among retail and professional investors alike.

Facilitating Cross-Border Crowdfunding in the EU

One of ECSPR’s key goals is to enable seamless cross-border crowdfunding under a passporting system. A licensed platform in one member state can notify other regulators and offer services EU-wide without obtaining multiple licenses. However, progress has been uneven, with regulatory interpretations and enforcement differing among countries. While frontrunners like France and the Netherlands have embraced ECSPR-driven cross-border activity, other markets still face fragmentation, limiting the pooling of European capital for startups. More on these challenges can be found in EuroCrowd’s analysis.

Practical Impact on Startups and Market Development

For startups, ECSPR brings more accessible and reliable capital sources within a regulated framework, increasing investor reach and fundraising success. The regulation also standardises campaign formats and reporting, making it easier for investors to compare offers across platforms and countries. This transparency supports market maturity and broadens crowdfunding’s role as a complementary funding channel alongside venture capital and traditional finance.

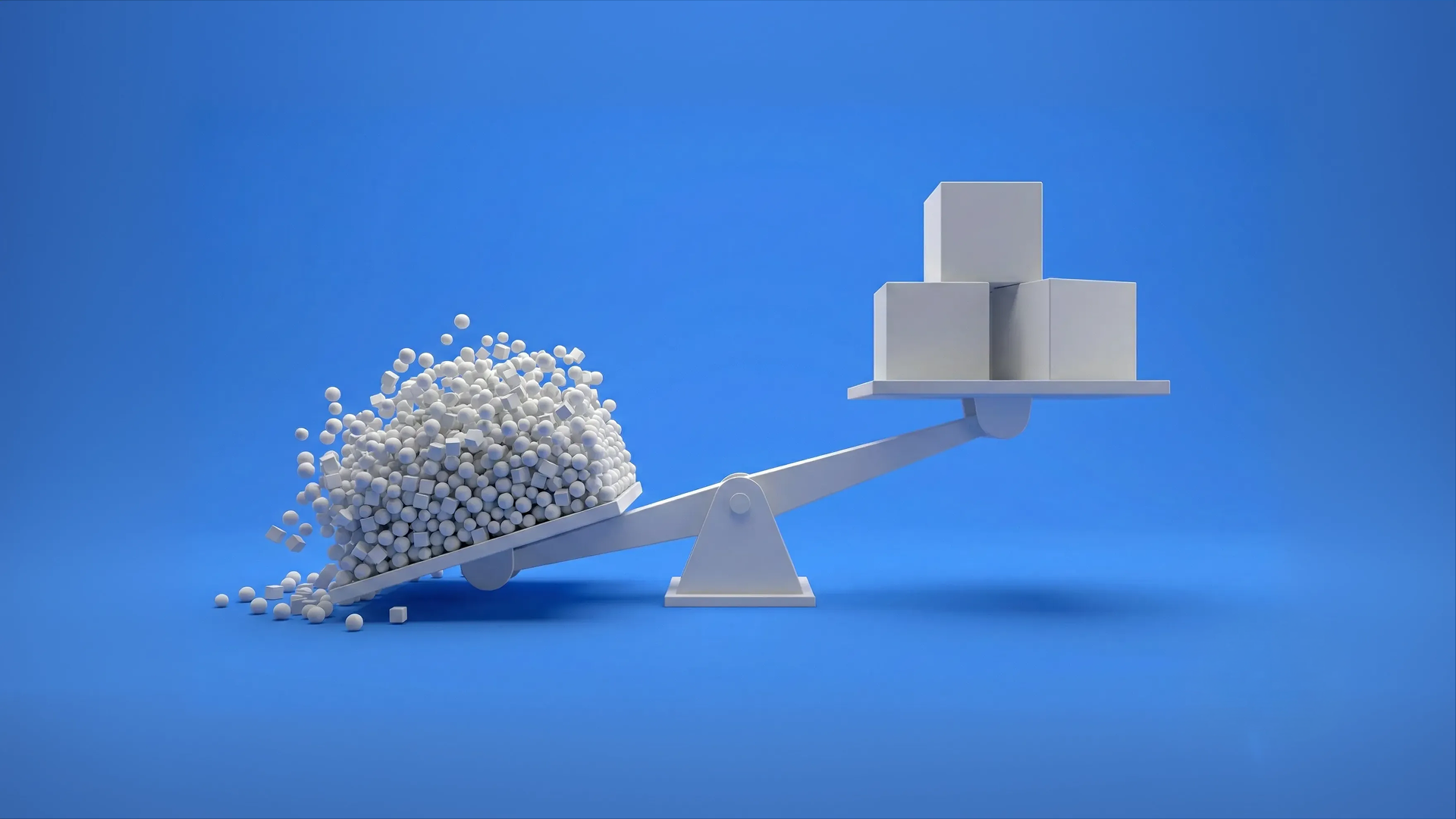

Challenges and Future Outlook for ECSPR

Despite its benefits, ECSPR faces challenges including fragmented national implementations and licensing delays that slow platform growth. Compliance costs can be prohibitive for smaller crowdfunding operators, leading to risks of market consolidation. Stakeholders are pushing for further harmonisation and regulatory simplification to unlock ECSPR’s full potential. Crowdbase, as a fully licensed ECSP platform, actively adapts to these evolving regulations to ensure seamless funding experiences while advocating for progressive policy improvements.

Conclusion

ECSPR has fundamentally transformed equity crowdfunding in Europe by setting high standards for platform operations, investor protection, and market integration. Going forward, its influence will continue to shape how startups raise capital and how investors participate in early-stage opportunities. Embracing ECSPR-compliant platforms like Crowdbase empowers startups and investors to confidently engage in a growing, regulated European crowdfunding market. Learn more about launching or investing in crowdfunding campaigns securely under the ECSPR framework with Crowdbase today.

More from Crowdbase

Discover more from our blog, guides and moreDon't miss the next opportunity

Sign up for our newsletter to be the first to know about new campaigns, updates and more!