Crowdfunding for Startups

Panayiotis Kakourides

COO

What is Crowdfunding for Startups and How Does it Work?

Crowdfunding for Startups has become a key method for raising capital, especially for new businesses looking to launch or expand. This funding approach allows entrepreneurs to gather money directly from a broad audience—the crowd—skipping the traditional routes of banks and venture capital. As more startups seek accessible and adaptable funding options, crowdfunding for startups stands out, providing both financial support and a way to gauge market interest in a product. With the keys to a successful crowdfunding campaign including a unique product or story that captures the interest of potential donors or investors, it's no wonder why this method has become popular for startups.

Understanding crowdfunding is essential for startups. It not only opens doors to new funding possibilities but also acts as a practical test to see if a product meets market demand. With today’s technology making fundraising platforms more accessible, startups worldwide are using this method to fuel their ventures. Whether you're considering fundraising for the first time or aiming to improve your strategy, this article will guide you through the key aspects of crowdfunding for startups. Our goal is to equip you with the knowledge to effectively navigate this funding landscape, helping your startup use crowdfunding strategically and successfully.

Understanding the Basics of Crowdfunding

Crowdfunding for startups is a financing method where new businesses gather funds from a large number of people, typically via the internet. This crowdfunding for startups approach leverages the collective efforts of friends, family, customers, and individual investors to support significant initiatives. Crowdfunding platforms facilitate these transactions by connecting project owners with potential backers who contribute small to substantial amounts towards achieving a set financial target through a fundraising campaign. Crowdfunding can be a valuable tool for small businesses looking to raise capital and gain support from a larger community of investors. Understanding the basics of crowdfunding is essential for startups and small businesses looking to utilise this funding method.

Although the modern version of crowdfunding emerged in the early 2000s with the arrival of internet platforms, the concept itself is far older. Historically, the idea of pooling resources from a community to support a common goal has deep roots. A prominent early example is the funding campaign for the Statue of Liberty’s pedestal in the late 19th century. Newspaper publisher Joseph Pulitzer launched a drive in his publication “The World” to raise the necessary funds. This campaign successfully gathered over $100,000 from roughly 125,000 donors, with most donations being less than a dollar. This demonstrates one of the earliest and most successful uses of a crowdfunding-like method to achieve a significant public goal.

The rise of digital crowdfunding platforms has transformed this age-old concept into a dynamic tool for the digital age. It democratised the funding landscape, enabling anyone with a compelling project and an internet connection to seek financial support. Over the last decade, crowdfunding for startups has soared in popularity as an alternative to traditional financing methods. This surge has been fuelled by the growth of the internet and social media, which have made it easier to share campaigns and attract a global audience for creative projects.

Today, startups use crowdfunding not just as a funding tool but also as a way to test market demand, refine products, and build a community of supporters who are invested in their success. As it continues to integrate into the entrepreneurial ecosystem, it is becoming increasingly embedded in the modern financial landscape. This method offers startups a dynamic platform to access capital while simultaneously building meaningful engagement with their market.

What are the Different Types of Crowdfunding for Startups?

Crowdfunding for startups can be segmented into four main types, each catering to different needs and stages of a business. Here's an overview of each type, including potential applications and suitability for various startup scenarios:

Equity Crowdfunding

Equity crowdfunding for startups involves investors contributing funds to a startup in exchange for equity, or shares. This means investors become partial owners of the company. It is particularly appealing for startups that are slightly more mature, planning significant growth, and looking to build a long-term relationship with their investors. For example, a tech startup aiming for rapid expansion might use equity crowdfunding for startups as an alternative way to raise capital for product development and scale operations, offering investors a stake in future profits.

Debt Crowdfunding

Debt crowdfunding for startups allows businesses to borrow money from a crowd of investors with the promise of repaying the principal plus interest rate. While it is less common for early-stage startups due to their limited financial history, more established startups with steady revenue streams might find this model appealing. It suits startups that can demonstrate strong financial health and the ability to manage regular repayment schedules.

Rewards-Based Crowdfunding

Rewards-based crowdfunding for startups involves individuals contributing money in exchange for a tangible item or service as a reward. It is ideal for Business-to-Consumer (B2C) startups and particularly effective for those with tangible, innovative products ready to be launched. For instance, a startup creating a new eco-friendly gadget might offer it as a reward to backers, effectively using the platform to pre-sell the product while funding its production.

Donation-Based Crowdfunding

In this fundraising method, contributors donate to support a project that aligns with their values or passions, without expecting any financial or tangible return. This type is uncommon for profit-focused startups. It is typically reserved for social, artistic, or community-focused projects that appeal to the sense of social responsibility or community support among potential backers. This makes it a valuable tool for supporting charitable causes and for social entrepreneurs looking to make a positive impact. Incorporating these crowdfunding methods into a startup's financial strategy depends on various factors, including the company's stage of development, business model, and long-term goals. Each type offers unique benefits and may pose challenges, making it crucial for entrepreneurs to carefully assess their options to align with their business objectives and market positioning.

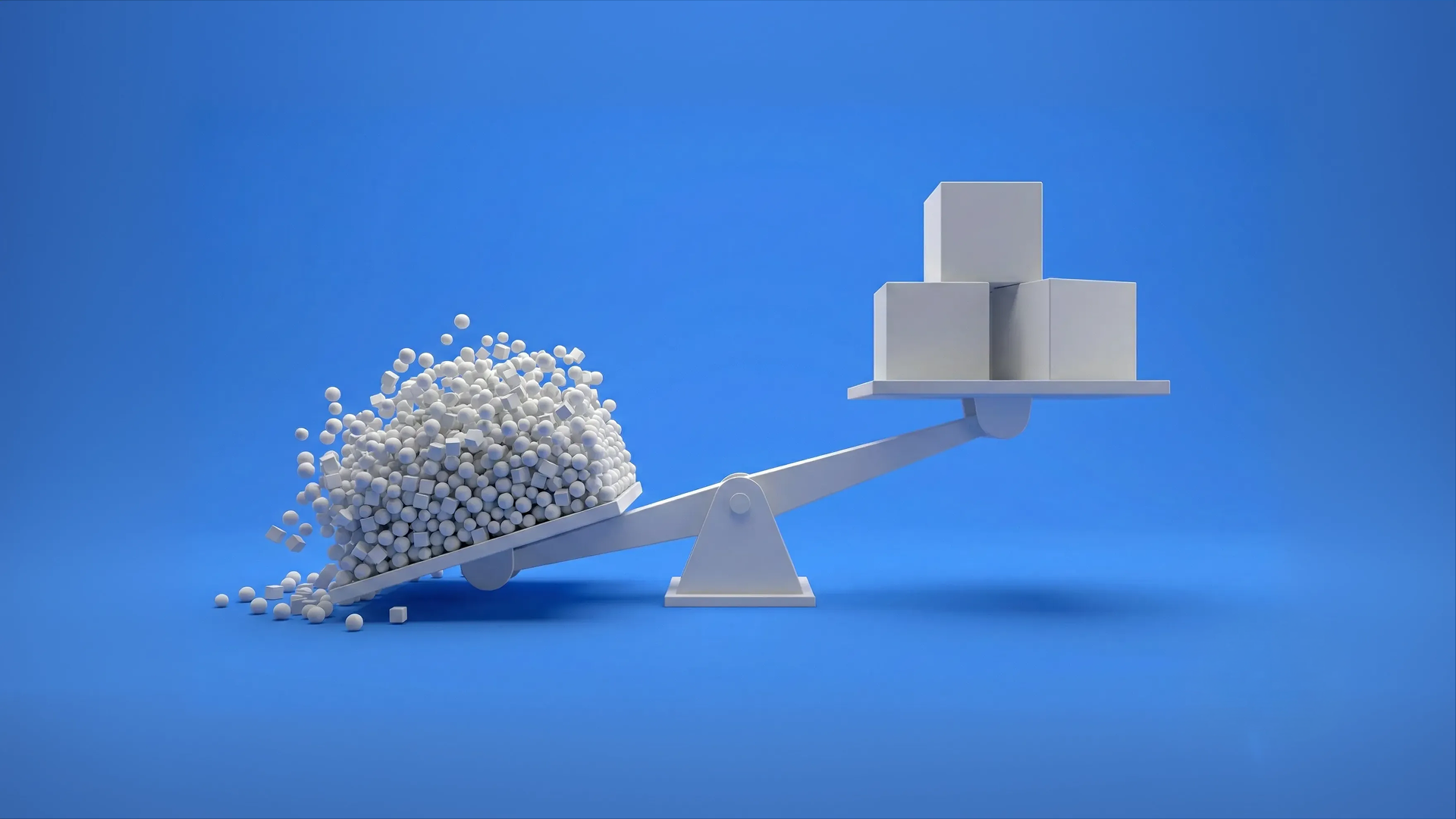

Benefits & Challenges of Crowdfunding for Startups

Crowdfunding for startups offers a unique avenue for new businesses to secure funding while engaging directly with their potential market. This method of raising capital has become increasingly popular due to its accessibility and versatility, but like any financing option, it comes with its own set of benefits and challenges. Understanding these can help startups navigate the complexities of this fundraising method effectively.

Benefits

- Access to Capital: Crowdfunding provides startups with the opportunity to access capital without the need for traditional financial intermediaries, such as banks or venture capitalists. This can be especially beneficial for early-stage companies that may not yet qualify for traditional loans or want to avoid the cumbersome process of raising funds from institutional investors.

- Market Validation: Launching a campaign allows startups to gauge consumer interest and validate their product or service before fully committing to production. This immediate feedback can be invaluable for refining the product and business strategy.

- Marketing Exposure: A successful campaign not only raises funds but also enhances brand visibility and marketing. As the campaign spreads through social media and other channels, it naturally increases the startup’s exposure and can attract future customers.

- Community Building: Crowdfunding creates a platform for startups to build a community of supporters who are emotionally and financially invested in their success. This community can provide not only funds but also valuable feedback and advocacy for the brand.

- Proof of Concept: Demonstrating success in a campaign serves as a proof of concept to potential investors and partners. It shows that there is a market demand for the product or service, which can help in securing additional funding or business opportunities down the line.

Challenges

- Funding Not Guaranteed: Unlike some traditional funding routes, campaigns may fail to meet their financial targets, and typically, if the target isn't met, no funds are raised at all. This all-or-nothing approach can be a significant risk.

- Public Exposure of Idea: Launching a campaign requires publicising your idea or business plan to a broad audience. This exposure can invite competition, particularly if the intellectual property protection is not robust.

- Intensive Campaign Management: Running a successful campaign demands substantial effort in terms of preparation, ongoing management, and post-campaign fulfilment. This can divert resources and focus from other business operations.

- Potential Over-Promising: In an effort to attract backers, startups might feel compelled to make ambitious promises regarding their products or rewards. Fulfilling these promises can become challenging and potentially costly if not managed correctly.

Choosing the Right Crowdfunding Platform for Your Startup

Selecting the appropriate platform is a crucial decision for any startup considering this route for raising capital. The right platform can amplify the reach and success of your campaign, while a poor choice can lead to wasted effort and resources. Several key factors need to be evaluated to ensure the platform aligns with your startup’s goals, product type, and financial needs.

In this section, we will explore various considerations that startups should take into account before committing to a platform. These include the fee structure, type of crowdfunding offered, the level of marketing support provided, the nature of the investor base, and the regulatory framework of the platform. Each of these factors plays a significant role in the overall effectiveness and suitability of the crowdfunding experience for your startup.

By carefully assessing each aspect, entrepreneurs can make an informed decision that maximises their potential for fundraising success and ensures a smooth campaign execution. Let’s delve into these critical factors to help you choose the best platform for your campaign.

Fees

Understanding the fee structure of a crowdfunding platform is critical, as these costs can significantly affect the total amount of capital a startup ultimately receives from a campaign. Here’s a breakdown of common fee structures you might encounter:

Commission on Funds Raised: One of the primary costs associated with crowdfunding platforms is the commission on funds raised. This fee is typically around 7%, but it can vary depending on the platform’s policies. Crowdbase, for example, employs a differentiated fee structure that aligns with the collaborative nature of crowdfunding efforts. The platform charges a higher commission for funds sourced through its network and a lower facilitation fee for funds that the startup brings in through its own efforts.

This tiered approach incentivises both the platform and the startup to actively participate in the fundraising process. It recognises that raising funds is a collaborative effort, leveraging the strengths and networks of both parties to maximise the campaign’s reach and success. By splitting the fees in this manner, the platform ensures that the interests of the platform are closely aligned with those of the startups, fostering a partnership that drives towards common fundraising goals.

- Preparation Fee: Many platforms require a preparation fee to cover the initial costs associated with setting up a campaign. This could be a flat fee or a small percentage of the minimum fundraising target. The fee is used to manage the administrative and due diligence processes needed before launching a campaign.

- Transaction Costs: Since transactions are processed online, there are invariably payment processing fees involved. These are generally charged in addition to the platform’s commission. It’s important for startups to account for these fees in their financial projections to accurately estimate the total cost of fundraising.

- Nominee Structure Fee: Some platforms use a nominee structure to manage all investor relations post-campaign under a single entity. This simplifies the management of multiple investors but typically requires the startup to pay a monthly fee for this service. The nominee structure helps in managing the cap table and investor communications efficiently.

- Additional Services: Platforms may also charge for additional services that can enhance the success of a campaign. These services might include the preparation of fundraising materials like pitch decks or financial projections, tailored marketing services to increase campaign exposure, and other add-on services that facilitate a successful campaign launch and execution.

When choosing a platform, it’s essential for startups to carefully review and understand all associated fees. This ensures there are no surprises during or after the campaign and helps in planning a budget that accommodates these costs. Startups should consider these fees as an investment into the campaign’s success and factor them into their overall fundraising strategy.

Platform Type

Choosing the right type of platform is crucial for successful startup funding, as it should align with their specific business model, stage of development, and funding needs. The two primary types that are most suited for startups are equity (or hybrid) and rewards-based crowdfunding.

Equity (or Hybrid) Crowdfunding: Equity crowdfunding is ideal for startups that are ready to scale operations and have already found a product-market fit. In this model, investors receive shares of the company, potentially with or without voting rights and possibly in a different class of shares tailored to new investors. This model appeals to startups and investors ready for a long-term commitment, looking to grow together.

A hybrid model often includes elements of both equity and debt, typically structured as a convertible loan. This starts as a debt instrument, accruing interest, but converts into equity during a future conversion event, such as a fundraising round. This type of financing is particularly appealing because it offers startups initial funding without immediate equity dilution, and provides investors with the potential upside of equity participation.

Rewards-Based Crowdfunding: Rewards-based crowdfunding is most suitable for very early-stage startups, particularly those with a B2C model focusing on tangible products rather than services. This model allows startups to gauge potential interest in their product before fully committing to large-scale production. Offering the product itself as a reward can significantly enhance the appeal of the campaign, as backers receive something tangible in exchange for their support. This approach is less viable for B2B startups, where finding suitable rewards that appeal to a broad investor base can be challenging.

B2C Vs B2B Models in Crowdfunding

While rewards-based crowdfunding typically aligns better with B2C startups due to the tangible nature of rewards, equity and hybrid crowdfunding can be suitable for both B2C and B2B models. B2B startups can successfully leverage equity or hybrid models by clearly communicating their value proposition and demonstrating potential returns to investors. Although B2B models can be complex and harder for the average retail investor to understand, a well-articulated business case can attract investors who are interested in the financial prospects rather than the product or service specifics.

Considerations for Choosing a Platform Type

- Stage of Development: Early-stage startups might benefit more from a rewards-based model to validate their product and market fit without giving up equity. In contrast, more established startups looking to scale might opt for equity or hybrid models.

- Business Model: B2C startups with tangible products can find success with both rewards-based and equity crowdfunding, while B2B startups, despite the challenges, can leverage the equity model if they effectively communicate their value proposition and return potential.

- Investor Engagement: Startups should consider how they want to engage with their investors. Equity and hybrid models often require building long-term relationships with investors who have a stake in the company's success, whereas rewards-based crowdfunding is typically transactional.

Selecting the appropriate platform type is a strategic decision that can significantly impact a startup's ability to meet its funding goals and support its long-term growth. Each type offers unique advantages and suits different kinds of startup needs and stages.

Marketing Involvement

When choosing a crowdfunding site, understanding the level of marketing involvement and support is crucial. The extent to which a platform assists with marketing efforts can significantly influence the success of a campaign. Different platforms offer varying degrees of marketing support, ranging from fully hands-on to none at all.

Types of Marketing Support

- Hands-On Marketing Support: Some platforms, like Crowdbase, provide comprehensive marketing services as part of the fundraising process. These platforms take the lead in designing and implementing specific marketing strategies tailored to each campaign. They utilise various channels to effectively communicate the value proposition and the investment opportunity to potential backers. This approach ensures that the campaign's marketing activities are not only effective but also compliant with regulatory standards. The advantage here is that the platform's experience in running multiple campaigns gives them insights into what resonates with investors, allowing them to craft strategies that maximise the potential success of the campaign.

- Limited Marketing Involvement: Other platforms may offer limited marketing support, such as providing templates for campaign materials or guidance on best practices for social media promotion. In these cases, the startup is largely responsible for executing the marketing plan and engaging with potential investors. Platforms may offer different packages at additional costs, which can include services like paid advertising, social media management, and public relations efforts.

- No Marketing Support: There are also platforms that provide no marketing support whatsoever. Startups using these platforms need to handle all aspects of the campaign promotion themselves. This can be a daunting task, especially for founders who may not have extensive marketing experience or the resources to hire marketing professionals.

Discussing Expectations and Responsibilities

It is essential for startups to discuss and clarify marketing responsibilities and expectations with the platform before launching a campaign. This discussion should cover who will be responsible for various marketing tasks, what level of support the platform provides, and whether there are additional costs involved for enhanced marketing services.

For platforms like Crowdbase that are actively involved in marketing efforts, the collaboration with startups often involves strategic planning sessions where the campaign’s goals, target audience, and key messages are defined. This collaborative approach ensures that the marketing efforts are aligned with the startup's vision and campaign objectives, while also adhering to regulatory requirements to ensure that all promotions are true, fair, and not misleading.

Reflecting on Marketing Support

Choosing the right level of marketing involvement depends on the startup’s own capabilities and resources. For those with limited marketing expertise or resources, a platform that offers extensive marketing support might be preferable. On the other hand, startups with a strong marketing team might opt for a platform that allows them more control over their campaign. Regardless of the choice, it's crucial that startups understand what is expected from both sides to avoid miscommunication and ensure the campaign's success.

Investor base

Choosing a crowdfunding platform with the right investor base is crucial for the success of your campaign. The alignment between the platform’s investor network and your startup's target market can significantly impact the outcome of your fundraising efforts.

Alignment with Target Markets: It's essential for startups to understand the geographic and demographic characteristics of a platform’s investor base. For instance, a startup operating in Cyprus would benefit most from a platform whose investor base predominantly consists of Cypriot or European investors. This is particularly advantageous if the startup’s business activities and customer base are also located within these regions. This alignment ensures that the people most likely to be your customers—and therefore most likely to understand and value your product—are also potential investors.

Transforming Customers into Investors: One of the strategic advantages of crowdfunding is the opportunity to transform existing customers into investors. When customers invest in your business, they become brand advocates who are likely to contribute not only capital but also promotional support, enhancing brand loyalty and expanding your market reach. Therefore, selecting a platform where there is a strong overlap between your customer base and the platform’s investor community can turn loyal customers into invested stakeholders.

Platform's Reach and Specialisation: Some platforms specialise in certain industries or types of investment (such as tech startups or green energy projects), which can attract a more targeted group of investors with an interest and expertise in those areas. Knowing the platform's specialisation can help in targeting the right investors who are not just willing to invest but are also enthusiastic about your industry.

Understanding the platform’s investor base helps in crafting a crowdfunding campaign that resonates well with potential investors, maximising your chances of success and ensuring that your investors are genuinely interested in your growth and success.

Regulatory Considerations

Navigating the regulatory landscape is a critical component when selecting a platform for crowdfunding for startups, especially for investment-based crowdfunding such as equity and debt models. Compliance with financial regulations is essential to ensure the legality and success of a campaign.

Understanding Local and International Regulations: Financial regulations can vary significantly from one country to another. However, within the European Union, the European Crowdfunding Regulation has harmonised the rules across all EU countries, facilitating platforms to operate across member states with greater ease. This regulation provides a standardised framework that simplifies the launch and operation of crowdfunding campaigns across the EU.

Global Operations and Compliance: For operations outside of the EU, crowdfunding platforms need to obtain specific licenses in each country where they wish to operate. This requirement can complicate efforts for EU-based platforms looking to expand internationally and for startups outside the EU looking to raise funds within it.

Startup's Responsibility: Startups must thoroughly research and verify that their selected crowdfunding platform is capable of legally operating in their country or target market. It is crucial for startups to ensure that the platform complies with all relevant local regulations to avoid legal complications that could jeopardise the campaign.

Regulatory compliance is a foundational aspect of planning a crowdfunding campaign, particularly for startups engaged in investment-based crowdfunding. Ensuring that all regulatory requirements are met not only protects the startup legally but also builds trust with potential investors by demonstrating commitment to transparency and legality.

Startup Capital Funding

Raising capital is a critical activity for startups at various stages of their growth. Each stage of funding, from pre-seed to later rounds, has specific objectives and characteristics. Understanding the nuances of each can help startups effectively leverage crowdfunding as a strategic financing tool.

Pre-Seed

Definition: Pre-seed funding is often considered the initial financial investment in a startup, used to get the business off the ground. This stage typically involves the founders, close family, friends, and perhaps angel investors.

Uses of Funds: Funds during this stage are generally directed towards market research, product development prototypes, and building a Minimum Viable Product (MVP). The goal is to validate the business concept and lay the groundwork for further development.

- Advantages

- Rewards-based crowdfunding can provide essential early-stage capital without equity dilution.

- It allows startups to test and validate their business idea with a broader audience, gaining valuable market feedback.

- Disadvantages

- The startup may not yet have a proven track record, which can make it harder to attract investors.

- Limited visibility and brand recognition can reduce the effectiveness of crowdfunding campaigns at this stage.

Seed

Definition: Seed funding is the next stage following pre-seed and often involves more substantial investment amounts. This round typically sees participation from angel investors and early-stage venture capitalists.

Uses of Funds: Capital raised during the seed stage is typically used for enhancing product development, increasing the team size, and initiating early marketing strategies to build customer traction.

- Advantages

- Crowdfunding at this stage can help establish a customer base and begin building brand loyalty.

- Provides an opportunity to further validate the product with a larger audience and refine the business model based on broader feedback.

- Disadvantages

- More significant amounts of money may be harder to raise solely via crowdfunding depending on the platform and investor interest.

- Startups may face increased pressure to deliver on promises to a larger pool of investors.

Series A & Later

Definition: Series rounds (A, B, C, etc.) are subsequent funding stages where startups typically raise larger sums from venture capitalists and institutional investors to scale operations aggressively.

Uses of Funds: Funds raised in these rounds are often used for scaling the business nationally or internationally, significant product diversification, and substantial market expansion.

- Advantages

- Crowdfunding can complement traditional funding sources by broadening the investor base and increasing public visibility.

- Engages a community of supporters who are financially invested in the success of the company.

- Disadvantages

- Crowdfunding might not be able to meet the high capital needs typical of these rounds without combining with traditional venture capital.

- Regulatory and logistical complexities increase with the size and scope of the funding round.

Each stage of startup capital funding presents unique opportunities and challenges for using crowdfunding. By carefully aligning their crowdfunding strategy with the needs and goals of their current stage, startups can maximise their funding effectiveness and support their growth trajectory.

Final Thoughts

Crowdfunding for startups has established itself as a versatile and accessible tool for startups looking to raise capital, validate their market, and build a supportive community. Throughout this guide, we've explored the various facets of crowdfunding, from understanding its basics and different types, to navigating the complexities of platform selection and regulatory compliance. Each segment has underscored the importance of careful consideration and strategic planning.

As we've seen, the choice between equity, debt, rewards-based, and donation-based crowdfunding hinges on your startup's stage of development, business model, and long-term goals. Platforms like Crowdbase offer robust support and a range of services that can significantly enhance the success of a crowdfunding campaign. However, it's crucial to align these services with your startup’s specific needs and the regulatory requirements of your operating region, especially if you are looking to raise a significant amount of money in a relatively short time frame.

Before embarking on a crowdfunding journey, startups should:

- Assess Their Needs: Clearly define what you need from a crowdfunding campaign beyond just capital. Consider aspects like market validation, community building, and marketing exposure.

- Evaluate Platform Offerings: Thoroughly research potential platforms to understand their fee structures, marketing support, investor base, and regulatory alignment. Choose a platform that not only meets your fundraising goals but also supports your overall business strategy.

- Understand Regulatory Implications: Ensure compliance with local and international regulations, which can vary significantly between regions and types of crowdfunding. This is especially critical for equity and debt crowdfunding.

Crowdfunding offers more than just financial benefits; it provides a platform to amplify your startup's visibility and forge meaningful connections with your audience. By strategically choosing the right type of crowdfunding and partnering with a platform that aligns with your business objectives, you can set the stage for sustainable growth and long-term success.

We encourage all startups to thoroughly evaluate their needs and capabilities before choosing to proceed with a crowdfunding campaign. With the right preparation and platform, crowdfunding for startups can be a powerful tool to launch and grow your business.

Frequently Asked Questions

More from Crowdbase

Discover more from our blog, guides and moreDon't miss the next opportunity

Sign up for our newsletter to be the first to know about new campaigns, updates and more!