Crowdfunding Greece: The Future of Capital Raising and Investing

Introduction

The startup ecosystem in Greece has seen some drastic growth and investment in recent years as the Greek economy starts to re-gain its strength. Examples of Greek startups which have massively succeeded are Viva Wallet, Blueground, Hellas Direct and many more. So far these startups had to mostly rely on funding from Venture Capital funds or Angel Investors.

However, as crowdfunding continues to grow in popularity globally and throughout Europe, particularly in the realm of investment and equity crowdfunding, it has become increasingly regulated. This regulatory framework ensures greater transparency and security for both investors and entrepreneurs, fostering trust and encouraging more participation in the crowdfunding ecosystem.

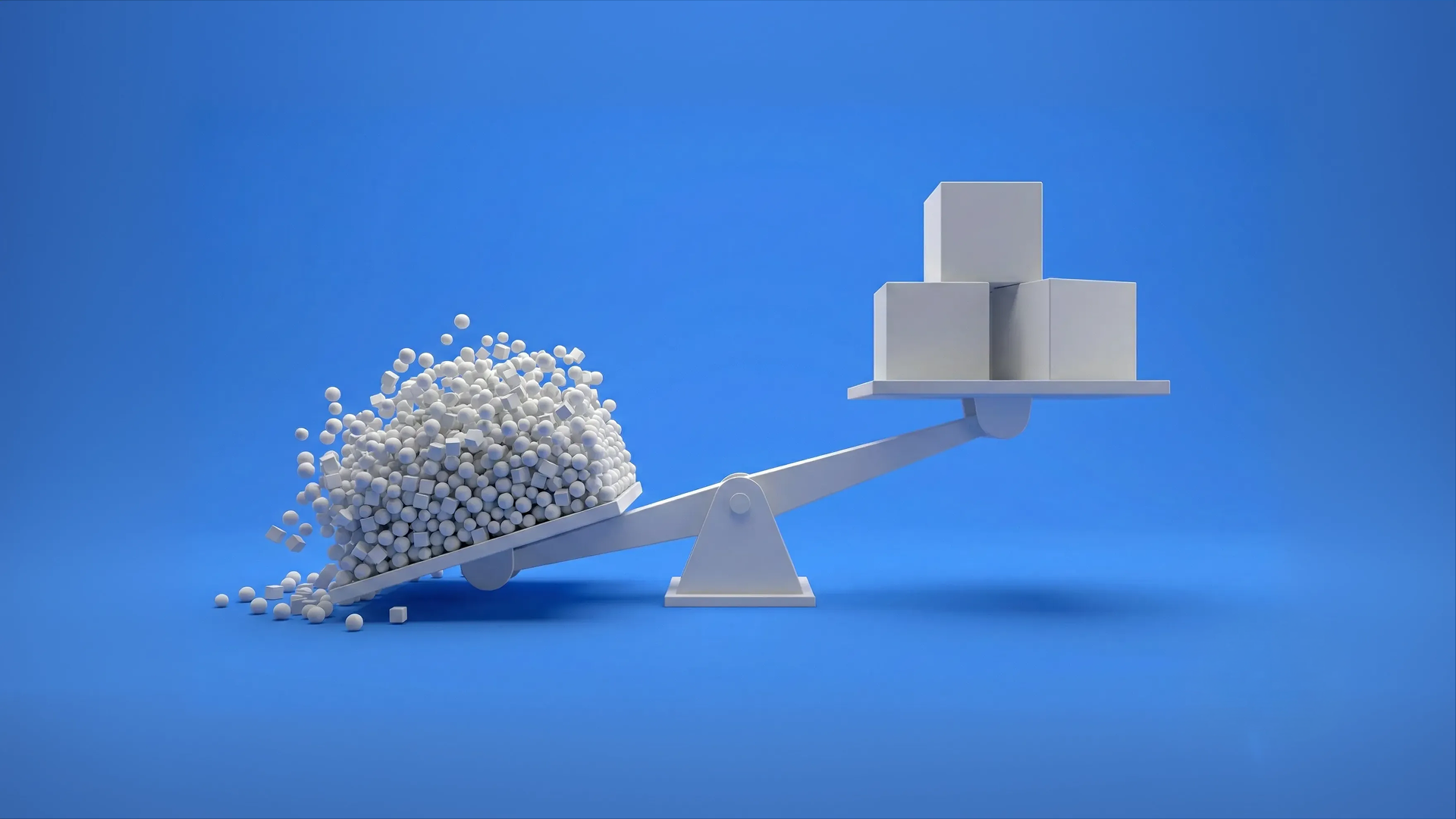

For Greek startups, this development is particularly advantageous, as it opens up new avenues for accessing capital and fundraising that were previously limited or unavailable. The ease of raising funds in euros and the alignment with EU financial standards further enhance the appeal of equity crowdfunding in Greece. As a result, crowdfunding not only has the opportunity to democratise access to capital in Greece but also to foster and enhance a vibrant ecosystem for innovation and economic growth.

Many Greek entrepreneurs are now turning to crowdfunding platforms not only to secure funding but also to validate their business ideas and connect with a broader network of supporters and potential customers. This shift is helping to drive innovation and economic growth within Greece, positioning the country as an emerging hub in the European crowdfunding market.

Introduction to Crowdbase

Crowdbase is a European licensed crowdfunding platform based in Nicosia, Cyprus. Our mission is to connect our community of investors with carefully selected startup and real estate opportunities that demonstrate high potential for success. Through a rigorous evaluation process, which includes thorough company investigations, in-depth discussions with founding teams, and comprehensive market research, we ensure that every project on our platform meets our high standards of viability and promise. This strict evaluation process has proven to enhance the trust our investors show in us, evidenced by our successful raise of over €1.5 million in investments to date through our platform. By linking innovative ventures with supportive investors, Crowdbase cultivates a dynamic ecosystem where entrepreneurial ideas can flourish.

Crowdbase is particularly committed to the Greek market, recognising its untapped potential and vibrant entrepreneurial spirit. We understand the unique challenges and opportunities faced by Greek startups and tailor our services to support their specific needs. By offering the option of crowdfunding in Greece as well as localised support, including services in the Greek language and transactions in euros, we facilitate easier access to funding for Greek entrepreneurs. Our alignment with EU regulations through obtaining the European Crowdfunding Service Provider License as well as being regulated by the Cyprus Securities and Exchange Commission (CySEC) further ensures that Greek investors can participate with confidence, knowing they are protected by the relevant regulatory frameworks. Through our dedicated focus on Greece, Crowdbase aims to empower a new generation of Greek innovators and contribute to the country's economic development and success in the European crowdfunding landscape.

Features and Benefits of Crowdbase for Greek Investors

At Crowdbase, we understand the unique dynamics of the Greek economy and are dedicated to customising our investment opportunities to meet its specific needs. Greece's rich tradition of entrepreneurship and innovation, combined with its strategic location within the European Union, provides fertile ground for promising startups and real estate ventures.

One of the primary advantages of using Crowdbase is access to a diverse range of projects. Our platform features carefully curated opportunities spanning various industries, allowing investors to build robust portfolios that align with their financial goals and risk appetites. With a low entry barrier of just €100, Crowdbase makes investing accessible to everyone, enabling individuals to diversify their portfolios by adding investments in fast-growing startups and innovative real estate developments.

The investment process on Crowdbase is straightforward and user-friendly. Registering and investing on the platform takes place entirely online and can be completed in less than 10 minutes. Transactions are conducted in euros, and investors can conveniently invest via debit/credit card or bank transfer.

To enhance investor confidence and engagement, we offer services in Greek, ensuring clear and effective communication. Our team provides ongoing support and expert guidance, helping investors make informed decisions and manage their investments effectively. This localised approach not only enhances the investment experience but also builds a strong, trusting relationship with our community.

Crowdbase is committed to nurturing the Greek entrepreneurial ecosystem by leading the way to crowdfunding in Greece and providing market insights and networking opportunities to help Greek startups scale and succeed. By supporting Greece's innovators and entrepreneurs, we aim to contribute to the country's long-term prosperity and establish a strong presence in the European crowdfunding market.

Crowdfunding for Greek Startups and Real Estate Projects

Crowdbase is dedicated to empowering Greek startups and real estate projects by providing a comprehensive crowdfunding platform tailored to their specific needs. Here’s how Crowdbase can uniquely support your venture in the Greek market:

Offering Greek startups and real estate projects strategic exposure to a wide network of potential investors and industry professionals that can aid in their fundraising. This visibility can help attract not only funding but also valuable partnerships and opportunities for collaboration that are essential for growth in the competitive Greek market.

Utilising Crowdbase allows you to gather critical market feedback early in your project’s lifecycle. By engaging with potential investors and supporters during your crowdfunding campaign, you can refine your offerings based on real-world input, increasing your chances of market success. This is particularly beneficial in Greece, where consumer preferences and market dynamics can vary significantly across regions.

Crowdfunding in Greece through Crowdbase can significantly boost your brand recognition and credibility. Successful campaigns often garner media attention and word-of-mouth publicity, helping to build a strong brand presence in a market that values personal connections and trust.

Crowdbase provides tailored campaign support to ensure your project stands out. Our team offers guidance on creating compelling campaign narratives, effective marketing strategies, and engaging with potential backers. This personalised support is crucial for navigating the unique business environment in Greece, where storytelling and personal relationships play a key role in business success.

Engage directly with a community that is interested in your project’s success. Crowdbase helps you cultivate a loyal following by facilitating meaningful interactions with your backers. This community engagement not only helps in fundraising but also in building a dedicated customer base, which is vital in Greece where community and loyalty are highly valued.

By leveraging Crowdbase, Greek startups and real estate projects can tap into the platform's extensive network and resources, gaining the support needed to turn innovative ideas into successful ventures. Crowdbase’s commitment to the Greek market ensures that you receive the localised support necessary to thrive in this dynamic environment.

Success Stories from Crowdbase

We are proud to share that Crowdbase has facilitated multiple crowdfunding success stories, including ventures that have their roots in Greece or have established operations there. These success stories are a testament to the potential of Greek startups and the effectiveness of our platform in connecting them with supportive investors.

One notable example is The Courtyard, our first real estate project where we managed to raise €574,010 from 76 investors. This project proved that our investor base is open to differentiating their portfolios into the real estate market, giving us the confidence to further explore the real estate crowdfunding market.

Another success story is Moving Doors, a Proptech company based out of Cyprus which has seen some exponential growth since its inception in early 2022. Moving Doors has managed to raise over €1 million from Greek-based VC funds, Genesis Ventures and Uni.Fund. Through Crowdbase they have successfully completed a bridge round to secure the necessary funds for further expansion into foreign markets.

These examples, among others, highlight the impactful role Crowdbase plays in supporting the Greek and Cypriot startup ecosystem. By providing access to capital and a platform for growth, we help turn promising ideas into successful ventures, fostering a vibrant entrepreneurial ecosystem in Greece and beyond.

Legalities and Regulations for Greek Crowdfunding

Investment-based (equity and debt) crowdfunding operates under a stringent regulatory framework designed to protect investors and ensure market integrity. Understanding these regulations is crucial for both investors and entrepreneurs looking to leverage crowdfunding platforms like Crowdbase. This section delves into the regulatory landscape governing Crowdbase, the general regulatory framework for crowdfunding, and the specific situation in the Greek crowdfunding market.

The Regulatory Framework of Crowdbase

Crowdbase operates under the European Crowdfunding Service Provider Regulation (ECSPR), which harmonises crowdfunding regulations across EU member states. This regulation ensures that platforms like Crowdbase adhere to strict guidelines aimed at protecting investors and maintaining transparency and fairness in crowdfunding activities.

With the implementation of the ECSPR, Crowdbase operates under a unified set of rules that facilitate cross-border crowdfunding within the EU. This regulation mandates that platforms offer transparent information, maintain high standards of governance, and protect investors through stringent oversight and compliance measures. By adhering to these regulations, Crowdbase ensures a secure and reliable crowdfunding environment for both investors and fundraisers.

General Crowdfunding Regulatory Framework

Crowdfunding regulation generally distinguishes between rewards and donation-based crowdfunding, which are less regulated, and investment-based crowdfunding, which includes equity and debt models and is subject to stringent regulations. The ECSPR plays a pivotal role in setting these standards across the EU, focusing on:

- Transparency: Platforms must provide clear and comprehensive information to investors.

- Investor Protection: Measures include ensuring platforms conduct thorough due diligence and provide accurate investment information.

- Market Integrity: Regulations aim to prevent fraud and ensure fair practices within the crowdfunding market.

The ECSPR enables seamless cross-border crowdfunding activities, allowing platforms to operate under a single set of regulations within the EU. This regulatory coherence is crucial for the growth and sustainability of crowdfunding as a viable funding mechanism.

The Greek Crowdfunding Regulatory Market

In Greece, the regulatory landscape for crowdfunding is still evolving. The Hellenic Capital Market Commission (HCMC) is the authority responsible for overseeing investment crowdfunding activities. However, to date, the HCMC has not issued any ECSP licenses, meaning no Greek-based platforms are currently authorised under this regulation.

This regulatory gap presents a unique opportunity for Crowdbase. With its ECSP license, Crowdbase can legally offer crowdfunding services to Greek startups and investors, filling the void left by the lack of local platforms. This not only positions Crowdbase as a pioneer in the Greek market but also allows Greek entrepreneurs and investors to benefit from a regulated, transparent, and secure crowdfunding environment.

By adhering to the ECSPR and the robust regulatory standards set by the Cyprus Securities and Exchange Commission (CySEC), Crowdbase provides Greek startups with access to essential funding opportunities while offering investors the confidence that comes with a regulated platform. As the Greek regulatory environment continues to develop, Crowdbase is well-positioned to lead the market, leveraging its expertise and regulatory compliance to foster a thriving crowdfunding ecosystem in Greece.

Conclusion

Crowdbase is at the forefront of transforming the Greek crowdfunding landscape by providing a secure, transparent, and accessible platform for both investors and entrepreneurs. Having significantly penetrated the Cypriot market and established itself as the clear market leader, Crowdbase aims to replicate this success in Greece. With tailored support for Greek startups and real estate projects, Crowdbase leverages its regulatory compliance and extensive network to foster innovation and economic growth. By connecting innovative ventures with supportive investors, Crowdbase plays a pivotal role in democratising access to capital and nurturing a vibrant entrepreneurial ecosystem in Greece, positioning itself perfectly for future growth.

Frequently Asked Questions

More from Crowdbase

Discover more from our blog, guides and moreDon't miss the next opportunity

Sign up for our newsletter to be the first to know about new campaigns, updates and more!