Real Estate Crowdfunding

Frixos Larkos

Co-Founder & CEO

Real Estate Crowdfunding - What is it?

Real estate crowdfunding is a way to raise capital from many individual investors who pool their money together to invest in a real estate project.

Do you find the concept of investing in real estate appealing but feel overwhelmed by the high expenses and intricacies involved? Explore how Real Estate Crowdfunding can transform your approach to property investment.

Real Estate Crowdfunding presents plenty of opportunities, enabling you to participate in real estate ventures conveniently and with adaptability. Whether you are an experienced investor or a novice, this article will walk you through essential information to help you make well-informed choices and optimise your real estate investment portfolio.

Imagine expanding your investment portfolio by owning fractions of various real estate assets, ranging from residential properties to commercial ventures. Through Real Estate Crowdfunding, you can seize unique investment opportunities, leverage collective investing, and receive passive income without the challenges of property management.

Are you prepared to guide your financial destiny? Delve into our complete article on real estate crowdfunding, where we will address topics from the fundamentals of crowdfunding to best practices on choosing suitable projects for you.

Start you journey towards financial freedom today!

Real Estate Crowdfunding: A Quick Introduction

Much like other types of crowdfunding, Real Estate crowdfunding is an alternative way to raise capital, but for real estate projects specifically. So, what is crowdfunding? It's when many individual investors pool small amounts of money together to invest in or buy real estate properties with the aim of making a return.

Through a crowdfunding platform like Crowdbase, individuals can easily find and invest in exciting real estate projects without worrying about the size of their investment, fixing the property, or letting it out to interested tenants. With the introduction of the European Crowdfunding Regulation, real estate crowdfunding is becoming a popular tool for raising capital within the real estate and startup communities, creating a whole new avenue for capital to flow through the economy.

Traditionally, real estate investing required a significant initial investment, often in the region of hundreds of thousands or more. As a result, this lucrative asset class was reserved only for High-Net-Worth Individuals. Now, through real estate crowdfunding, anyone can invest, with a minimum investment as low as €500!

Crowdfunded Real Estate is especially popular for innovative and socially impactful projects that can benefit the community. These projects can include renewable energy, sustainable infrastructure and restoration and preservation of culturally significant buildings.

How Real Estate Crowdfunding Works

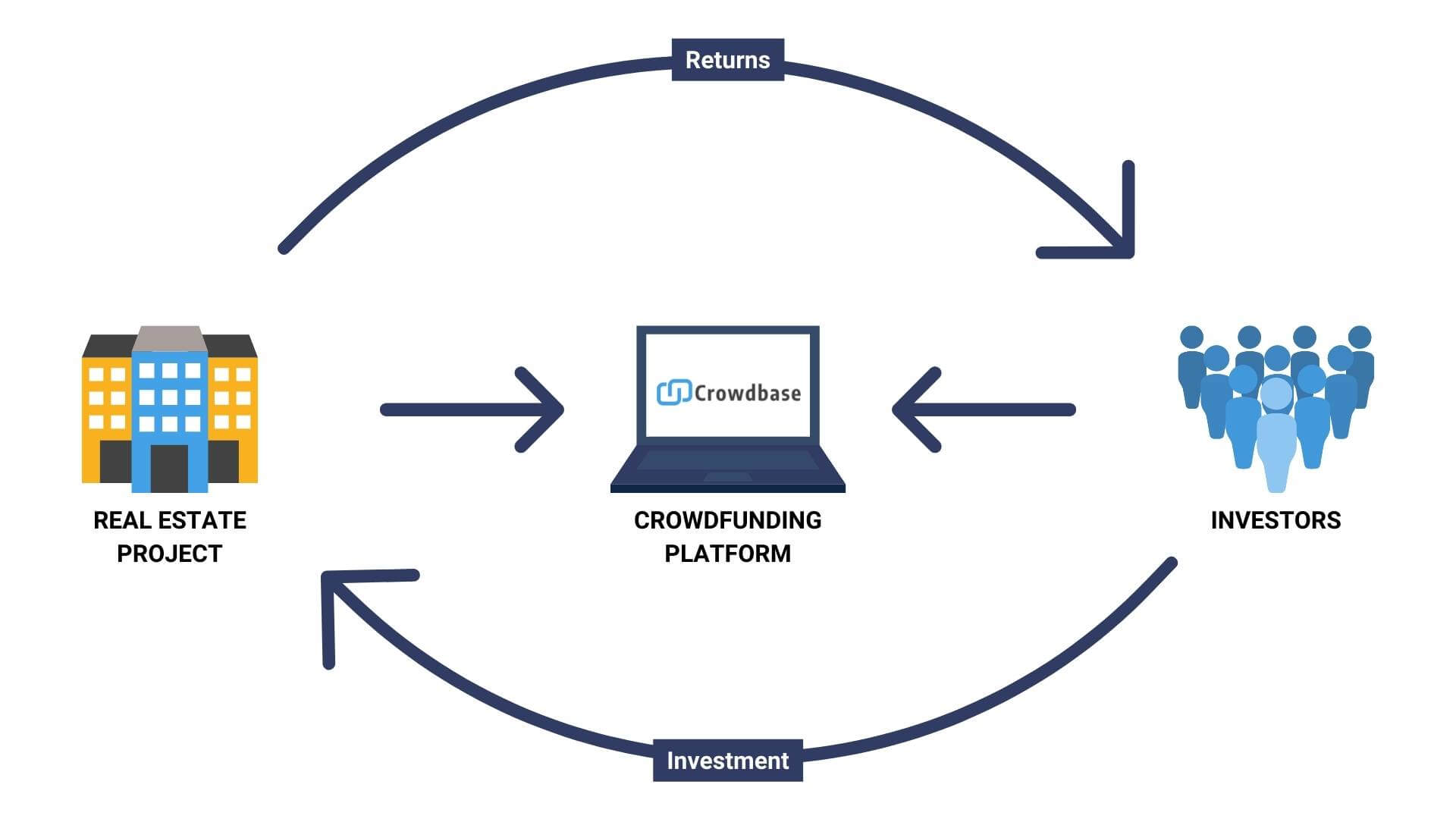

Real estate crowdfunding is not that different from other types of crowdfunding. Let’s explore the three parties involved in real estate crowdfunding campaigns and what each one does.

- Project Owner: As host of the campaign, the Project Owner originates, plans, and oversees the investment project’s execution. This party is often an individual or a team with real estate experience, or a property developer. They will find the property, negotiate the purchase price, plan for any work that needs to be done and rent or sell the property. The Project Owner will usually contribute a significant amount of capital, effort and time to align their interests with the investors. They may also receive additional compensation for their work if stated in the investment thesis.

- Investors: As backers of the campaign, investors commit their capital to the project in exchange for a share of ownership. Investors may be entitled to recurring income or one-time payments, depending on the deal’s structure. This can result from the property being rented out or an outright sale.

- Platform: As a mediator, the platform is where sponsors and investors come together. The platform acts as a neutral intermediary, facilitating the exchange of funds and ownership between Project Owners and investors. It is responsible for ensuring the quality and authenticity of investment opportunities and advertising available deals to the crowd. It also ensures that Project Owners’ and investors’ identities are verified, and all regulatory standards are followed. Lastly, the platform is also responsible for collecting the funds from investors and safekeeping them with a reputable financial institution until the campaign is completed.

The diagram below illustrates how the three parties come together for a crowdfunding campaign. Also, the diagram highlights the flow of investment and returns from the project.

Pros and Cons of Real Estate Crowdfunding

Real estate investing is not suitable for everyone, but it can be the ideal starting point for many. It tends to be a lower risk investment, given that its value is usually supported by tangible assets, like land or buildings.

Investing in real estate through crowdfunding can provide a steady flow of additional income, supplementing your monthly salary. Additionally, with the rise of technology, there are now various real estate crowdfunding platforms available, making it easier than ever to invest in real estate.

The Pros of Real Estate Crowdfunding

- Can regularly provide a stable income stream if the property is rented out.

- Potential for higher-than-expected returns through the property’s price appreciation (e.g. due to the area’s development).

- Relatively stable value with minor deviations in the price of tangible assets.

- Returns with public securities are not strongly correlated, providing an opportunity to diversify your portfolio further.

- Allows individuals to benefit from a property’s returns without the difficulties of managing the property themselves.

- Allows access to otherwise unattainable investments like high-rise buildings and other large scale property developments.

- Individuals can leverage the knowledge and expertise of specialised professionals instead of doing the research alone.

The Cons of Real Estate Crowdfunding

- Exposed to high execution risk during property transactions such as buying, renovating, and selling.

- Investments can be highly illiquid, limiting the speed at which you can free up your capital.

- Market volatility may affect property values and investment returns, just like with every other investment.

- Dependency on the success of the project's location and development for returns.

- Potential for unforeseen costs and delayed construction timeframes, impacting overall profitability.

Crowdbase aims to address some of these challenges by carefully reviewing Project Owners to assess their experience and reputation, which may help minimise execution risks and the risk of unforeseen costs and delays. To enhance liquidity, Crowdbase aims to provide a bulletin board where investors can advertise their intention to buy or sell securities, offering an additional option for those who wish to sell early.

Types of Investments

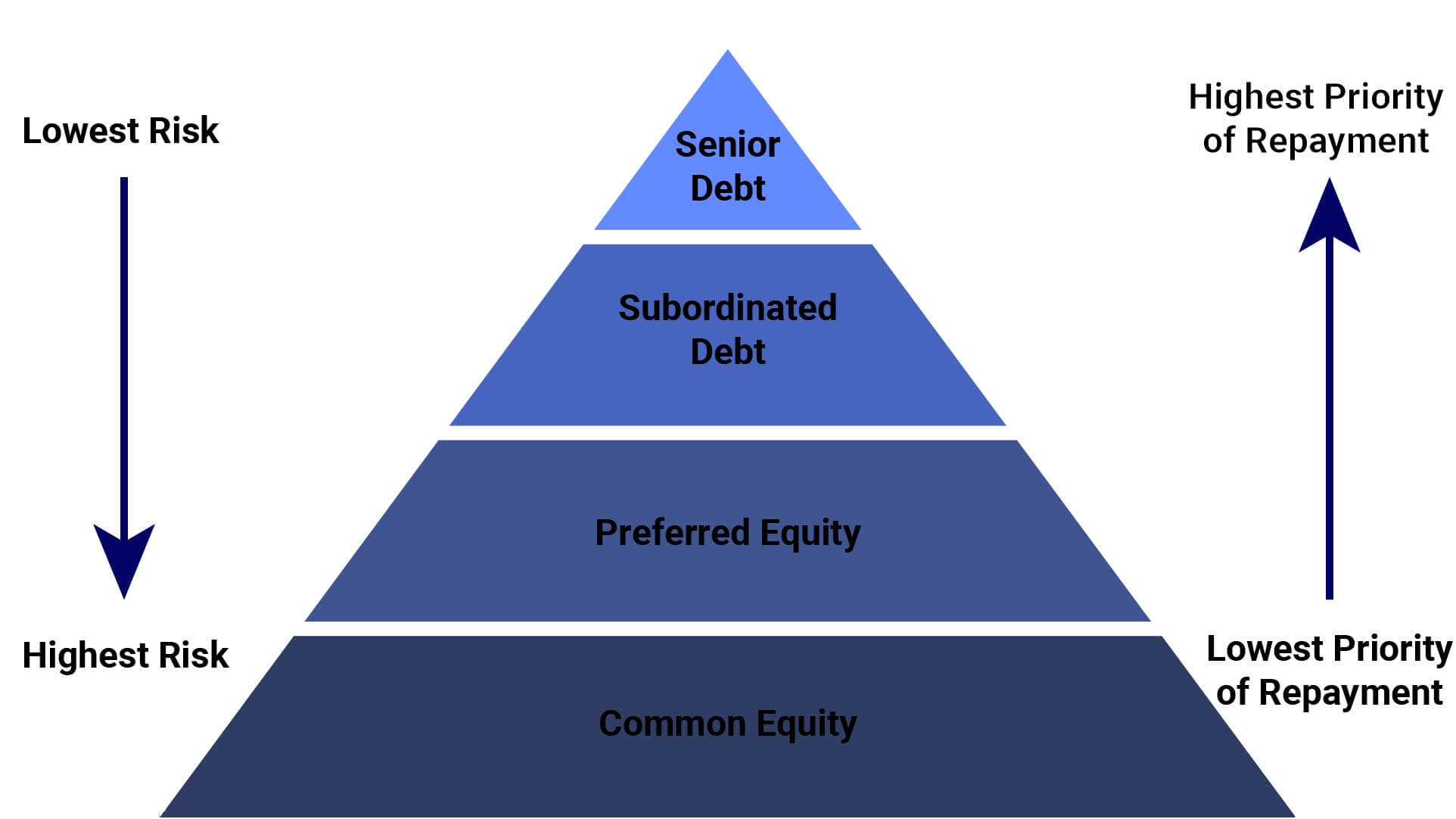

Real estate crowdfunding can be divided into two investment categories with unique risk-reward characteristics as outlined below:

Equity Real Estate Crowdfunding

Equity investment provides direct ownership of a property or a company managing/owning the property. Investors of this type have unlimited upside potential but are also the first to bear any losses. If market rent rates and/or property prices continue increasing, shareholders of the project will keep turning in a profit.

Conversely, suppose market rent rates or property prices drop to the point where the property is liquidated. In that case, shareholders are exposed to a significant loss of their investment. Being the lowest in seniority level, investing in equity is, more often than not, much riskier than investing in debt.

Debt Real Estate Crowdfunding

Debt investors act as a bank in that they lend money to Project Owners to use for the real estate project. Debt investments usually provide fixed, regular payments until maturity, depending on the structure of the deal. Interest rates vary with the project’s riskiness, but they typically fall within the 5-15% range.

Returns from this investment type are capped, meaning that even if the property’s price increases by a lot, you won’t get to share any profits. However, debt holders are more senior to equity holders, and therefore will lose less money in a liquidation event (bankruptcy).

Who can invest in Real Estate Crowdfunding?

Real Estate Crowdfunding opens doors to aspiring real estate investors, especially those who are beginners in the field of real estate investing. It's a perfect avenue for individuals seeking to learn how to become a real estate investor without the hefty commitments associated with traditional property purchases.

You can invest as little or as much money as you want, making it accessible to anyone interested in building wealth through real estate. It follows the same logic as buying a property on your own, but you can access this opportunity without the hassle that comes with it.

However, if you desire complete control over the investment's budget, management, and strategy, you might want to explore other avenues through our platform, such as creating a campaign through Crowdbase as a Project Owner.

Now that we have a better understanding of who can invest, let's explore the two types of investors.

Real Estate Investment Goes Digital

The digital age has revolutionised the real estate investment landscape, providing opportunities for individuals with varying levels of capital and expertise to participate in this market. Crowdfunding platforms have emerged as a popular option, allowing investors to pool their resources and invest in properties collectively.

These platforms offer a low barrier to entry, enabling even those with limited capital to access real estate investments, something that was not possible before the rise of real estate crowdfunding platforms. Through these platforms, investors can access a diverse asset portfolio of real estate opportunities, including residential, commercial, and industrial projects available for investment.

Additionally, real estate investment trusts (REITs) have become increasingly popular in the digital era. REITs allow investors to buy shares in a portfolio of properties, providing diversification and passive income without the need for direct property ownership. This option is ideal for those looking to build a real estate portfolio or looking for a hands-off approach to real estate investment.

Moreover, technology has made real estate investment more accessible, providing various new opportunities for those wanting to start investing or broaden their portfolios.

Two notable trends are:

- Real Estate Crowdfunding: This democratises real estate investing by allowing individuals to pool resources and invest in properties they couldn't afford on their own. Online platforms streamline the process, providing access to pre-vetted deals, from residential to commercial projects. This lowers the barrier to entry and offers potential diversification benefits.

- Digital Real Estate: This fascinating frontier encompasses investment in virtual assets. Think of it like owning a piece of the internet. This includes income-generating websites and blogs, the lucrative domain name market, and the rapidly expanding virtual land within metaverses. While this space carries higher risk and volatility, it also presents significant growth opportunities for the tech-savvy investor.

Where They Intersect

Blockchain technology is further blurring the lines between traditional and digital real estate. Tokenization allows for the fractional ownership of physical real estate assets, creating a bridge between these spheres. Additionally, investors increasingly find opportunities to purchase and develop virtual land within metaverses, opening up a new dimension of real estate investment.

Whether through crowdfunding platforms that facilitate investment in tangible properties, or the exciting frontier of digital real estate ownership, the digitalisation of the industry has opened doors for a wider range of investors.

Investing in Commercial and Residential Real Estate

Commercial properties can bring in more money and have longer leases, but they might need a bigger upfront investment. On the other hand, residential properties can be easier to start with and offer steady income through rent. Whether you're looking to invest in a shopping mall or a cozy house, we'll guide you through what to expect and how to make the most of your investment.

Investing in Commercial Real Estate

Commercial real estate investing involves the purchase, ownership, and management of properties that are used for business purposes. This type of investment can include office buildings, retail centers, hotels, and other spaces used for business activities.

Investing in commercial real estate offers several advantages, such as potentially higher returns compared to residential properties, longer lease terms, and the opportunity to diversify your investment portfolio. However, it also comes with its own set of challenges, including higher upfront costs, longer vacancies between tenants, and potential market fluctuations. One unique benefit of investing in commercial property is the dependable income stream it can provide, with investors often receiving cash distributions on a monthly or quarterly basis.

Successful commercial real estate investing requires thorough research, financial analysis, and a deep understanding of market trends. It is essential to assess factors such as location, property condition, tenant quality, and potential for future growth before making any investment decisions.

Moreover, investors can choose from various strategies in commercial real estate investing, including buying and holding properties for rental income, flipping properties for quick profits, or participating in real estate investment trusts (REITs) for more passive investments.

Overall, commercial real estate investing can be a lucrative venture for those willing to put in the time and effort to understand the market dynamics and make informed decisions based on their financial goals and risk tolerance.

Investing in Residential Real Estate

Residential real estate encompassess the acquisition, ownership, and management of properties designed for non-commercial, living purposes. This category typically includes single-family homes, apartments, duplexes, condos, and townhouses. Investing in residential real estate can offer numerous benefits, such as steady rental income and appreciation potential over time. Unlike commercial real estate, residential properties often have lower entry costs and a broader market of potential renters, making it an accessible investment option for many.

However, residential real estate investment is not without its challenges. These can include managing tenant relationships, handling maintenance and repair issues, and navigating the legalities of leasing and property management. Moreover, market conditions, location, and property condition play crucial roles in the success of residential real estate investments. Investors must conduct comprehensive research, perform due diligence, and stay informed about local real estate market trends to make informed decisions.

The strategies for investing in residential real estate are diverse, ranging from purchasing properties for long-term rental income, rehabilitating distressed properties for resale, or investing through real estate crowdfunding for those seeking a more hands-off approach. Each strategy requires a different level of involvement and risk tolerance, making it important for investors to align their choices with their investment goals and personal capacities.

Overall, residential real estate investment can be a rewarding path for those looking to diversify their investment portfolio, generate passive income, or build wealth over time. It demands a strategic approach, patience, and a willingness to engage with the market's dynamics.

Final Thoughts: Real Estate Crowdfunding's Potential

Real estate crowdfunding has democratised real estate investing. By allowing individuals to pool resources, these platforms open up opportunities previously limited to large institutions and wealthy individuals. Investors benefit from lower barriers to entry, potential diversification, and the chance to invest in projects alignining with their values.

While any investment carries risk, real estate crowdfunding offers an easy way for individuals to diversify their investment portfolios and potentially support positive change in their communities. Additionally, this type of investment typically pays generous dividends, making it especially appealing for investors looking for high-yield opportunities.

Ready to see what real estate crowdfunding can offer? Explore the active investment opportunities on our platform.

Frequently Asked Questions

What is the average expected return on real estate crowdfunding investments?

The average expected return on real estate crowdfunding investments can vary widely, typically ranging from 7% to 15% annually. This range depends on factors such as the type of investment (equity or debt), the property's location, and the project's risk profile. It's important for investors to review each project's specifics to understand its return potential.

How long are typical investment horizons in real estate crowfunding?

Investment horizons in real estate crowdfunding can range from short-term (6-12 months) to long-term (5 years or more), depending on the project. Debt investments tend to have shorter durations, while equity investment usually require a longer commitment to realise potential gains from property appreciation.

Can I sell my investment in a real estate crowdfunding project early?

Liquiditiy varies by platform and project. Some platforms offer a secondary market allowing investors to advertise their intention to buy or sell securities from projects crowdfunded through the platform, but this is not always guaranteed. It's vital to understand the liquidity terms before investing.

How does real estate crowdfunding compare to REITs?

Real estate crowdfunding and Real Estate Investment Trusts (REITs) both offer exposure to real estate markets, but there are differences. Crowdfunding allows investors to select specific projects to fund, potentially offering higher returns and direct impact, but with higher risk. REITs, on the other hand, provide a diversified portfolio of properties, usually with more liquidity and lower risk, but often with lower potential returns.

Περισσότερα από την Crowdbase

Ανακάλυψε περισσότερα από το blog μας, οδηγούς και άλλαΜη χάσεις την επόμενη ευκαιρία

Εγγραφείτε στο newsletter μας για να ενημερώνεστε πρώτοι για νέες καμπάνιες, ενημερώσεις και πολλά άλλα!