Certificate of Innovative Enterprises (CIE)

Frixos Larkos

Co-Founder & CEO

The Deputy Ministry of Research, Innovation and Digital Policy has renewed the tax incentives scheme for investing in Certified Innovative Enterprises. It aims to promote the development of entrepreneurial ventures in Cyprus through the support of local investors.

Just a quick note before we dive in: we're sharing this information to help you understand the tax incentives for investing in Certified Innovative Enterprises. However, it's always a good idea to check in with your tax advisor before making any decisions. Also, keep in mind that policies can change, so some of this information might become outdated over time.

For Investors

Who is eligible?

To be eligible for the tax deductions, one must satisfy ALL of the following conditions:

- An individual who is currently taxed in Cyprus.

- An independent investor, meaning you are not already invested in the business. This includes not being an existing shareholder, with an exception for founders and private investors when starting a new business.

- Invest directly or through an investment fund/alternative trading platform (like Crowdbase) in an innovative business.

- Ensure that the securities you purchase are newly issued and not acquired from other investors.

Income Tax Relief

Investors can deduct a significant portion of their invested amount from their taxable income, subject to the following provisions:

For natural persons:

- The deduction may not exceed 50% of the total taxable income of that person in the tax year in which the investment is made.

- The amount deductible may not exceed €150,000 a year.

- Deductions not claimed due to the above conditions may be carried forward for up to five (5) years.

- The percentage of the eligible investment that can be deducted depends on the type of innovative SME and falls into one of the following categories:

- 50% Deduction: Applies if the innovative SME has not yet engaged in any market activities.

- 35% Deduction: Applies if the SME has been active in any market for less than ten (10) years since its incorporation or less than seven (7) years since its first commercial sale.

- 20% Deduction: Applies if the SME requires an initial venture capital investment that, according to its business plan, exceeds 50% of its average annual turnover over the previous five (5) years, either for the development of a new product or for entry into a new geographical market.

For legal entities:

- The deductible amount cannot exceed 30% of the invested amount, whether directly or through an investment fund or alternative trading platform.

- The amount deductible may not exceed €150,000 a year.

- Deductions not claimed due to the above conditions may be carried forward for up to five (5) years.

In practice, the tax savings can vary depending on your personal or corporate tax bracket and the nature of the investment. This deduction can represent a significant portion of the investment and can be claimed regardless of the company's performance. Therefore, it can be considered a substantial financial incentive for your investment.

Please note that tax deductions are only available for investments made in ordinary shares. Investments made via other financial instruments, such as convertible loans, are not eligible under the current policy.

How to Claim Your (CIE) Tax Relief

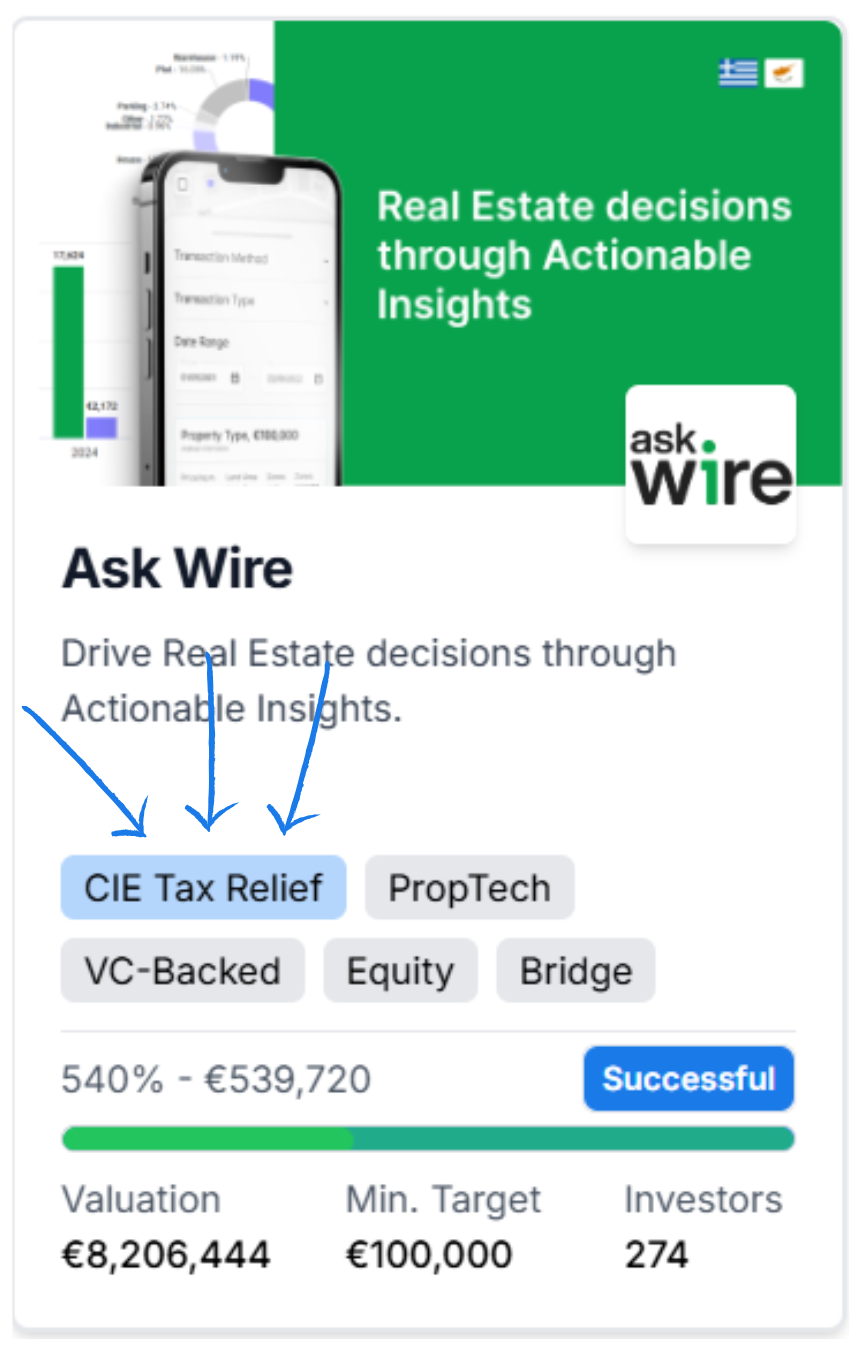

Have you invested in a company with a Certificate of Innovative Enterprise (CEI) through our platform? These are clearly marked with the "CIE Tax Relief" tag on our platform. Here's how to claim your deduction.

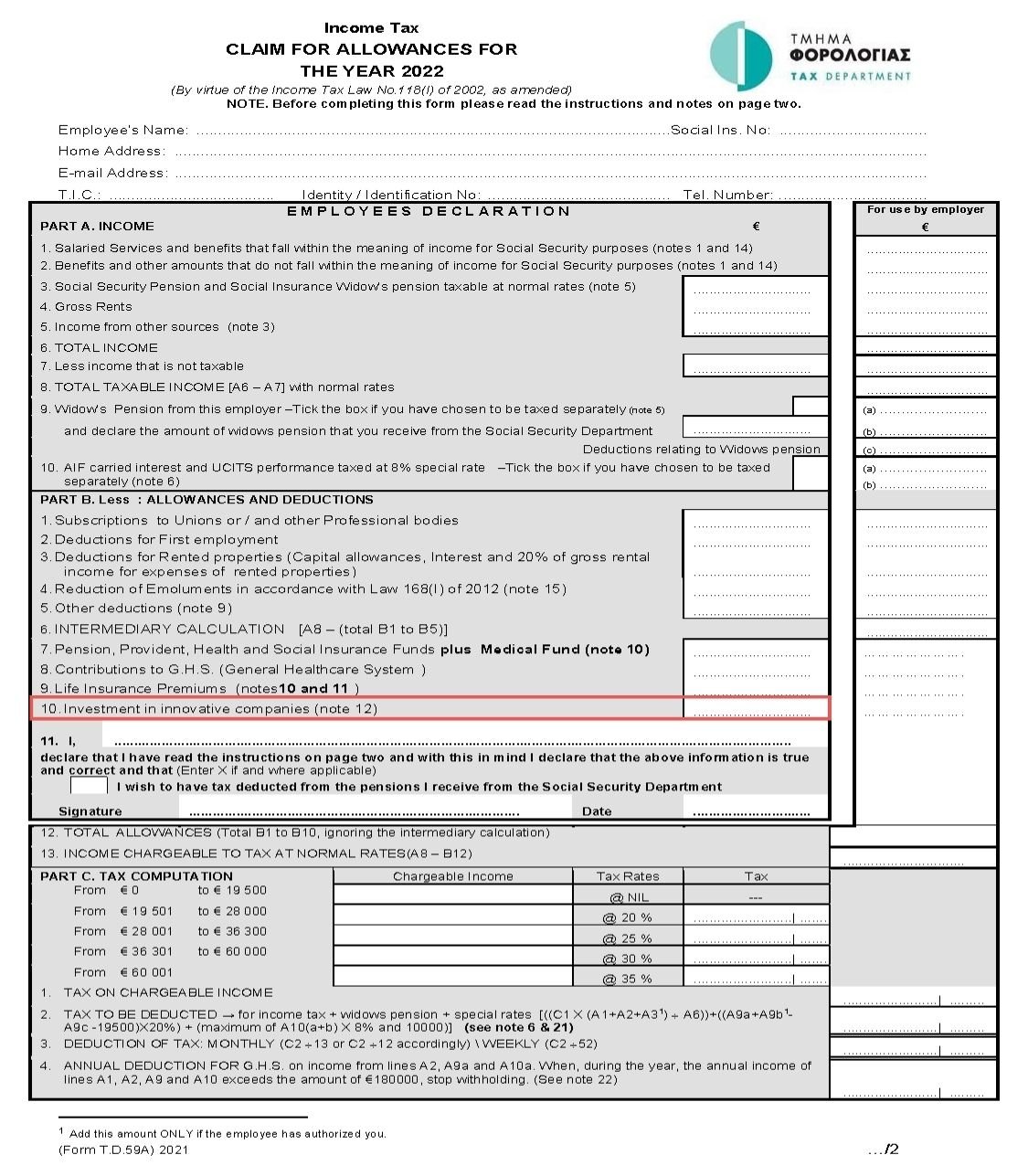

When you are filling in your annual income tax claim for allowances (TD 59), in part B, point 10 (marked in the image below), you can add your investment in the company to be deducted from your gross taxable income.

In accordance with the restrictions of the scheme we have described above, the deduction is generally restricted to 50% of your income after all deductions, including deductions for health, life, provident and others. However, depending on the category of the innovative SME you invest in, the eligible deduction might be 50%, 35%, or 20% of your investment.

At the end of each campaign that is eligible for the tax relief, we will issue a relevant investment certificate to every investor, so they can use it as supporting evidence in the case they are asked by the tax authorities.

Further Conditions

Before investing and claiming your tax deductions, you may also want to consider the circumstances in which the tax relief may not be granted:

- If you do not hold the investment in the innovative enterprise for a minimum of 3 years.

- If you claim a deduction that exceeds the allowance set by the legislation, which varies based on your investment category (50%, 35%, or 20% of the eligible investment).

- If the total venture capital financing exceeds the thresholds established by Regulation (EU) No. 651/2014, as amended in 2023.

Tax relief is only applicable if the investment is made in ordinary shares of the certified innovative enterprise. Convertible loans or other financial instruments do not qualify under the updated policy.

Eligible Enterprises

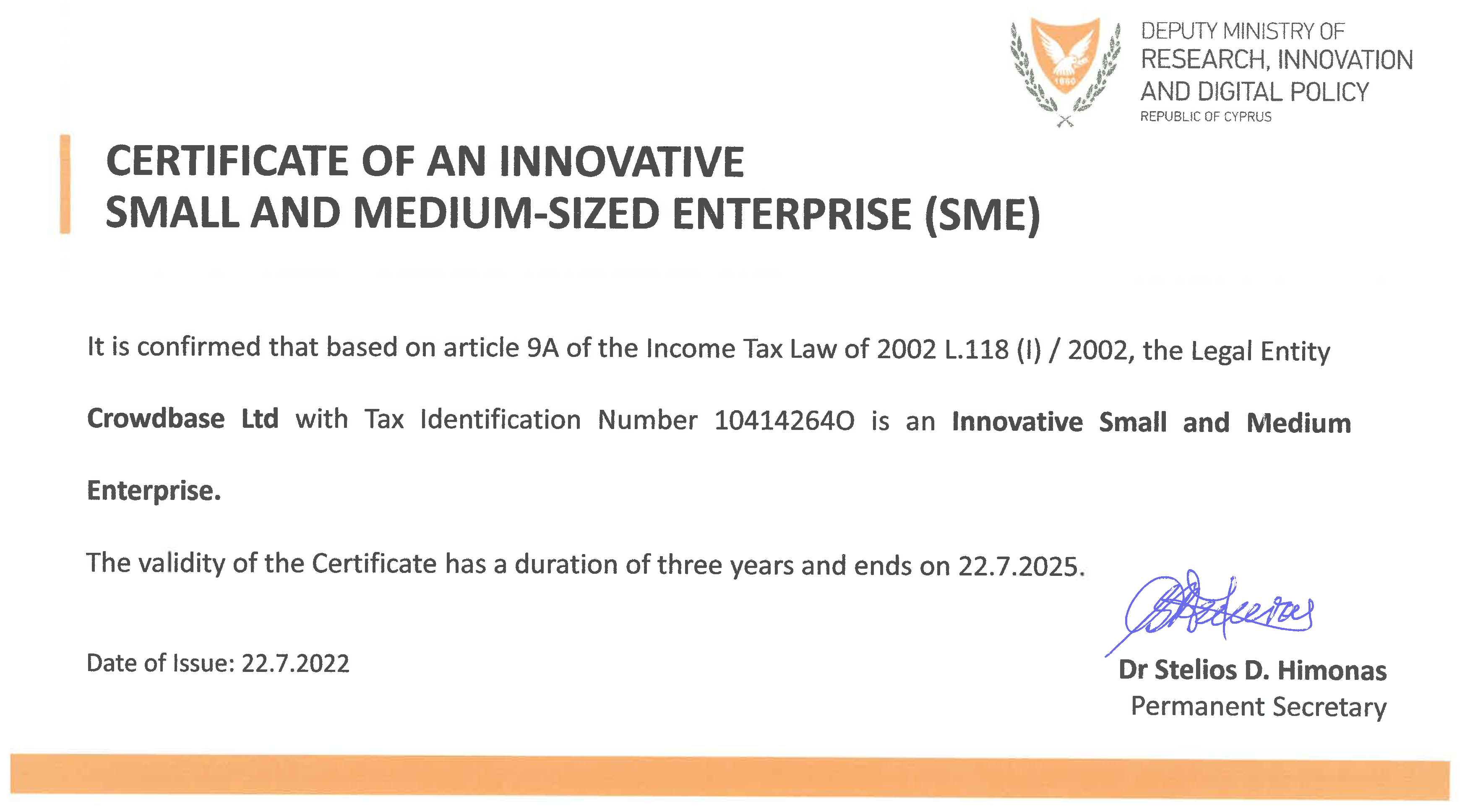

For each innovative enterprise, a relevant certificate will be issued, which will have a duration of 3 years.

For investments made through Crowdbase, innovative enterprises will be clearly marked with the "CIE Tax Relief" tag (Certified Innovative Enterprise) on the crowdfunding campaign page, and the certificate will be displayed in the Documents tab of the campaign.

Alternatively, the Deputy Ministry maintains a list of all the certified innovative businesses here, which you can use to verify a company’s status.

For Companies

How is an innovative SME defined?

According to the legislation, an SME can be registered as innovative if it meets the following criteria:

- It operates in Cyprus: The company must conduct its business activities within the Republic of Cyprus.

- Business Plan: The SME must have drawn up a business plan for the venture capital investment.

- Meeting at least one of the following conditions:

- Not currently active in any market: The SME does not yet conduct any market activities.

- Active for less than ten years: The SME operates in any market for less than ten (10) years after its registration with the Registrar of Companies or for less than seven (7) years after its first commercial sale.

- Significant initial investment required: The SME requires an initial business risk financing investment based on a business plan for a new product or market expansion, which is higher than 50% of its average annual turnover over the past five years.

- Non-listed: The company must not be listed on the Cypriot or any other stock exchange.

- Investment Cap: A company ceases to be considered innovative if it receives more than €15 million in venture capital investments.

How do I apply to become an innovative business in Cyprus?

If your business satisfies the criteria set above, then you can submit an application to the Deputy Ministry at [email protected]. However, before sending your application, you should read through all available information on the dedicated page.

Below is a summary of the evaluation process depending on whether your company has an existing financial history, no financial history or is eligible for a certificate without an evaluation.

For existing companies with a financial history

Companies with an existing financial history must provide a certificate from their external auditors verifying that they have invested more than 10% of their operating expenses in research and development in at least one of the previous three years.

- Consistency Requirement: This certificate must be consistent with the company's audited financial statements. Additionally, the expenditure on research and development must be clearly stated in the financial statements.

- Eligibility Confirmation: If the company satisfied this condition and is verified by the Deputy Ministry, the company is eligible for a certificate.

For new ventures and startups without financial history

If you are a newly founded startup without any financial history, then you will need to submit a business plan as per Annex 3.

- Business Plan Requirements: The business plan must be in English, in PDF format and should be between 10 and 15 pages. It should describe the ability to develop new or clearly improved products, services or processes with high technological or industrial risk, which are characterised as innovative in their sector.

In addition, the business plan must cover the following topics:

- Value proposition: Describe the business in a single sentence, including what it does, how it does it, and why.

- Problem: Outline what the problem is today and why the current solutions are inadequate.

- Solution: Demonstrate your company’s value proposition to solve the problem described above and why now is the right time.

- Market Opportunity: Provide evidence and research of the potential market and steps you have taken to validate it.

- Competition: List current competitors and explain how you will differentiate from them.

- Proprietary Technology: Describe any proprietary technologies or intellectual property you have developed.

- Monetisation Strategy: Describe your revenue sources, pricing model, break-even point and other business metrics/KPIs.

- Marketing Plan: Outline how you find and engage with your customers.

- Team and Key Stakeholders: Highlight key team members, including their skills, expertise and experience relevant to their roles.

- Financial Projections: Provide a three-year financial forecast, including cash flow analysis and unit economics.

Two independent evaluators will then evaluate the business plan based on the criteria described above. If the business plan secures a score greater than 11 (out of 15) from both evaluators, then the company is eligible for a certificate.

In the rare case that the business plan scores 11 (or higher) out of 15 from only one evaluator, it is scored by a third evaluator. If the third evaluator gives a score greater than 11, the company is eligible for certification.

Eligible companies that receive a certificate without evaluation

Companies that have previously participated in various local and European programs may be eligible for a certificate without further evaluation. If your company satisfied any of the following conditions in the last three years, then it is eligible for certification:

- The company has secured funding from one of the SME Instrument Programs, EIC Pathfinder and EIC Accelerator of the EU Horizon 2020 Financing Program or Horizon Europe 2021-27.

- The company has received a Seal of Excellence in the Programs mentioned above.

- The company has secured funding from the PRE-SEED, SEED, or INNOVATE Innovation Programs or other innovation programs of the Research and Innovation Foundation.

- The company has secured a Startup Visa.

Qualifying companies can submit proof that they meet at least one of the above criteria. Upon confirmation of the receipt by the Deputy Ministry, the company is eligible for a certificate.

Approval or rejection of an application

The Deputy Ministry of Research, Innovation, and Digital Policy approves or rejects the designation of the company as an innovative small and medium enterprise (SME) within one month of receiving a completed application. Additionally, the Deputy Ministry may request additional information and clarifications about the company before issuing the certificate.

Procedure for renewal of an innovative company certificate

To renew the Innovative Business Certificate, the company must submit a certificate from an external auditor, confirming that research and development costs represent at least 10% of its total operating costs in at least one of the previous three tax years. This certificate must be consistent with the company's audited financial statements.

Disclaimer

The information provided in this article is for general informational purposes only and does not constitute professional tax advice. Crowdbase is not a tax advisor, and the content herein should not be considered as such. We strongly recommend consulting with a qualified tax advisor before making any investment decisions or taking action based on this information.

More from Crowdbase

Discover more from our blog, guides and moreDon't miss the next opportunity

Sign up for our newsletter to be the first to know about new campaigns, updates and more!